UK DIY News

Barclays Reveals 2025’s Top 10 Consumer Spending Trends

- Pharmacy, health and beauty was 2025’s strongest performing category, up 9.5 per cent, as the ‘lipstick effect’ and wellness boom spurred spending

- Entertainment grew 4.3 per cent, with consumers prioritising memorable moments even when making cutbacks

- Confidence in household finances fell from 70 per cent in January to 64 per cent in November, while confidence in the UK economy averaged 24 per cent throughout 2025

- The Barclays report combines hundreds of millions of customer transactions with consumer research to provide an in-depth view of UK spending

Consumer card spending declined -0.2 per cent year-on-year in 2025, after growing 1.6 per cent in 2024 and 4.1 per cent in 2023. In a year marked by careful and considered budgeting, confidence in household finances consistently exceeded confidence in the economy. Some non-essential categories, such as beauty, travel and entertainment, bucked the general trends, as shoppers once again prioritised affordable treats and experiences that bring them joy.

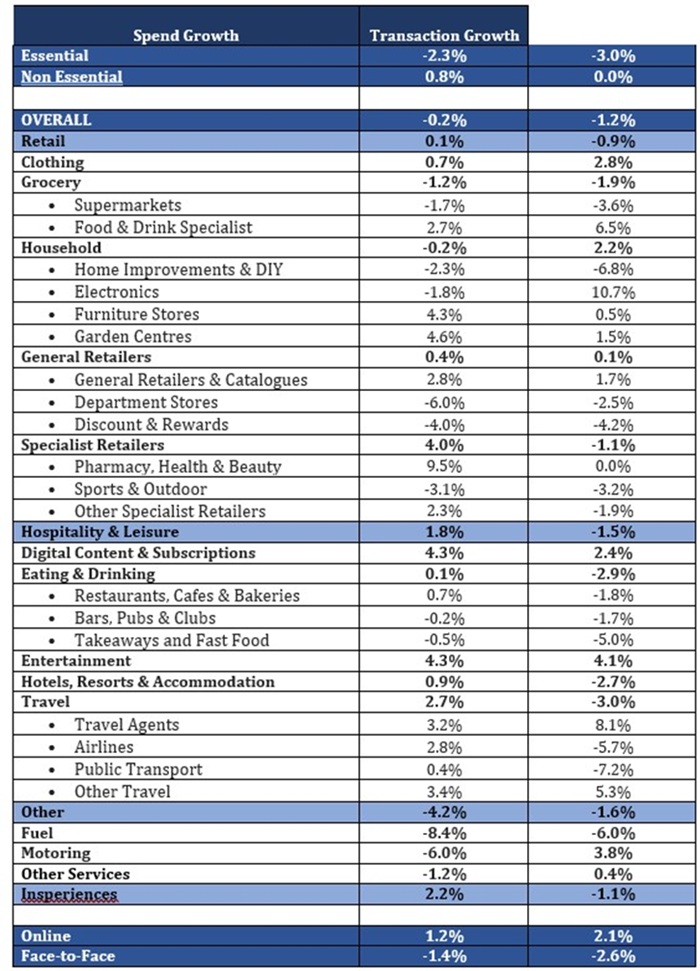

New data from Barclays reveals that essential spending declined -2.3 per cent in 2025, down from 0.9 per cent growth in 2024. Non-essential spending increased marginally, up 0.8 per cent, however this lagged behind the latest CPIH inflation rate of 3.8 per cent.

The Barclays Consumer Spend report, which combines hundreds of millions of customer transactions with consumer research to provide an in-depth view of UK spending, reveals the top 10 trends that shaped consumer behaviour this year.

1) Consumers prioritise non-essentials despite economic uncertainty

Confidence in the UK economy remained low in 2025, with a monthly average of one in four adults (24 per cent) feeling confident in the nation’s economic strength. In October, all seven measures of consumer and economic confidence tracked by Barclays declined for the first time since August 2022, when the Bank of England announced its biggest base rate increase in 27 years.

However, supported by prudent budgeting, at year-end, the majority remain confident in their household finances (64 per cent) and their ability to spend on non-essentials (52 per cent), although both measures have declined since January (from 70 per cent and 56 per cent respectively).

Linked to this confidence in discretionary spending, consumers found room in their budgets for experiences and “feel-good” purchases in 2025. Growth in non-essential spending consistently outpaced essential categories throughout the year, even when consumer and economic confidence were subdued. Almost half (44 per cent) of consumers say they like to treat themselves regularly, but find ways to do it on a budget, which led to categories such as pharmacy, health and beauty (9.5 per cent) and food and drink specialists (2.7 per cent) receiving a boost.

2) Beauty and wellness now non-negotiables

2025’s strongest performing category, pharmacy, health and beauty, saw double-digit growth in several months of 2025, marking close to five years (56 months) of consistent growth. Those spending on the pharmacy, health and beauty category splashed out £324 each on average, up from £291 in 2024, as the “lipstick effect” – when consumers buy small, affordable luxuries as a pick-me-up – persisted, while 71 per cent of consumers say they’ve invested in wellness in the last 12 months.

Earlier in 2025, Barclays chronicled the rise of male beauty spending, revealing that almost one in five (19 per cent) men now care more about beauty than they did 10 years ago, further contributing to the category’s success. Further, a quarter of men (25 per cent) have now incorporated skincare into their daily routine, and one in eight (12 per cent) have spent money on a cosmetic procedure.

3) AI and technology aid money management

Over a third (35 per cent) of consumers, and 70 per cent of Gen Z, have used AI tools in the last year for budgeting, planning, and shopping. Of the 65 per cent who are yet to make use of AI, half (50 per cent) prefer to manage things without the help of tech, 42 per cent don’t trust AI and 30 per cent have privacy and data concerns.

The growth of AI is also transforming how people approach sales; 37 per cent of shoppers said they would use AI during their Christmas shopping, rising to 53 per cent for those aged 18-34. This group is turning to AI to research products (43 per cent), compare prices and deals (34 per cent), generate gift ideas (31 per cent) and set up personalised alerts (25 per cent).

4) The ‘Experience Economy’ and Oasismania

2025 saw a marked shift towards spending on experiences over material goods, as consumers opted to make more meaningful memories. The entertainment category enjoyed growth of 4.3 per cent over the course of the year, as major events, such as Coldplay’s World Tour and Sabrina Carpenter’s Short ‘n Sweet tour, drove significant spikes in spending, while the greatest increase was seen in April, when A Minecraft Movie was released, at 13.2 per cent. Consumers spent £316 on average on memorable moments, while 16 per cent said that they spent more in 2025 on entertainment compared to last year.

Also contributing to this surge was Oasis’ reunion tour. Barclays’ Wonderwallets research in April found that Oasis fans anticipated they would spend a combined total of £1.06bn attending the highly awaited reunion tour, with attendees planning to splash out an average of £766.22 each to see the Gallagher brothers reunite at one of the 17 UK concert dates.

5) Streamflation and the digital content boom

Streaming’s golden age continued in earnest, with spending on digital content and subscriptions up 4.3 per cent, following the success of shows such as White Lotus, Severance and Adolescence in 2025. One of the year’s biggest streaming hits was animated film KPop Demon Hunters, which boosted the category by 5.6 per cent in June as fans broke viewing and soundtrack records - with hits like "Golden" topping the charts.

Nine in 10 (90 per cent) UK adults say they’re now signed up to at least one streaming service to get their entertainment fix, however, 52 per cent of customers reported they had noticed instances of ‘streamflation’ (the rising cost of streaming services), while the average spend on digital content and subscriptions in the year totalled £378.

6) Savvy, value-conscious shopping

Cost-of-living pressures led to a widespread adoption of budgeting strategies, with nearly two-thirds of consumers (64 per cent) consistently looking for ways to get more value from, or reduce the cost of, their weekly shop. Meanwhile half (50 per cent) are making the effort to cut back on discretionary spending.

Consumers’ price sensitivity meant there was a continued focus by manufacturers and retailers on tactics such as “skimpflation” (57 per cent), where the quality of certain products or ingredients declines, without a corresponding drop in price, and “drinkflation” (37 per cent), where alcoholic drinks become smaller or contain less alcohol, yet cost the same or more than they used to, up from 22 per cent in 2023. Three quarters (76 per cent) reported concern about shrinkflation, and a similar proportion (74 per cent) noticed food products becoming more expensive.

Thos cutting food costs are making use of loyalty schemes (56 per cent), discount supermarkets (49 per cent), own-brand alternatives (45 per cent), and the revival of the “big shop” (31 per cent).

7) Travel spending slows

Travel spending remained resilient in 2025, up 2.7 per cent, however this represented a decline from 2024’s growth of 6.9 per cent. Travellers spent £1,158 on average each on the category. In a drive to keep costs down, many opted to travel at off-peak times or during the shoulder season (54 per cent) and used AI tools for planning and budgeting their holidays (27 per cent).

Among this group, the top uses are creating itineraries (35 per cent), researching and choosing destinations (32 per cent) and translation (30 per cent), while over a quarter (27 per cent) are finding and comparing prices, discounts and deals with these tools.

8) Furniture and home as comfort investments

Furniture stores grew 4.3 per cent overall, having declined -2.2 per cent in 2024, as consumers invested in their living spaces, five years on from the pandemic. Spending at furniture stores grew in each month of 2025, the most sustained growth for the category since 2020. This trend was partly driven by new homeowners and their desire for “pick-me-up” purchases that enhance comfort at home.

Furniture stores enjoyed a particularly strong month in June, up 8.2 per cent, after a record number of mortgage completions took place in March 2025, ahead of April’s stamp duty changes.

Similarly, garden centres, which fell -2.4 per cent in 2024, saw strong growth of 4.6 per cent year-on-year as buyers looked for ways to spruce up their outdoor areas.

9) Support for British-made and local products

Amid widespread uncertainty post-Liberation Day when the US announced sweeping tariffs on the import and trade of international goods, two thirds of UK consumers (67 per cent) cited concerns about the prices of imports. Meanwhile 71 per cent said they would buy more items that were “Made in Britain”, and one in eight said they would be willing to pay a premium for local products (12 per cent).

Similarly, seven in 10 (68 per cent) said they wanted to support UK businesses by buying more home-grown products, with this trend supporting growth in food and drink specialist stores and local retailers, up 2.7 per cent overall in 2025.

10) Fitness-driven socialising and low/no alcohol choices

2025 saw the rise of “low-and-no” alcohol options and fitness-based gatherings, as nearly a third of consumers (31 per cent) said they have changed how they socialise in the last 12 months. Two in five (41 per cent) of those aged 18-34 say they now like to combine social catchups with exercise such as meeting for a gym class, cycle or run, while 48 per cent opt to socialise in ways that support health and wellbeing).

This wellness trend is leading many to cut back on nights out - two fifths (44 per cent) of adults reported going on fewer nights out in 2025, with spending at bars, pubs and clubs declining -0.2 per cent year-on-year, after experiencing 3.6 per cent growth in 2024.

Karen Johnson, Head of Retail at Barclays, said: “While confidence in the UK economy has declined, UK households’ confidence in their ability to manage their money has remained strong, translating into the resilient performance of categories such as travel, entertainment and beauty. It is encouraging to see that through purposeful spending, consumers continue to prioritise the things that bring them joy, unlocking the potential for UK economic growth.”

Overall 2025 growth figures

Source : Barclays

Source : Barclays

Image : William Barton / 753265135 / shutterstock

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.