UK DIY News

B&M: Profits Drop As Turnaround Plan Progresses

B&M European Value Retail S.A. ("the Group"), the UK's leading variety goods value retailer, today announces its interim results for the 26 weeks to 27 September 2025.

Tjeerd Jegen, Chief Executive Officer, said:

"Our Back to B&M Basics plan is progressing and we are taking decisive actions to improve our retail execution and restore our financial performance. While the full financial benefits will build over time, I am confident our actions can restore sustainable like-for-like (LFL)1 sales growth at B&M UK, which is our number one priority and, in the medium term, low double-digit UK adjusted EBITDA2 margins as an outcome. In the meantime, our store presence in the UK and France continues to expand, supporting Group revenue growth as we reach new customers and support them in these uncertain economic times.

We continue to strengthen our capabilities and I am pleased to announce the appointment of Simon Hathway as our new Group Trading Director. Simon brings significant retail experience, including as Buying and Merchandising Director at Action Holding B.V., and I look forward to his start at B&M. I am also pleased to welcome Helen Cowing as our Interim Chief Financial Officer, who brings a wealth of CFO experience from a variety of corporate backgrounds, including Selecta Group, FatFace and Mobico Group plc8.

Lastly, I am pleased to confirm I am bringing responsibility for our Supply Chain and Retail operations under Jon Parry, one of our most experienced retail leaders, in order to create a simpler and more cohesive structure that brings our Store and Supply Chain teams even closer together. I would like to thank Gareth Bilton, Mike Schmidt and James Kew for their commitment to B&M and wish them well for the future."

Headline measures | H1 FY26 | H1 FY25 | Change |

Group revenue | £2,749m | £2,644m | 4.0% |

Group adjusted EBITDA (pre-IFRS 16)2 | £191m | £274m | (30.2)% |

Group adjusted EBITDA (pre-IFRS 16)2 margin % | 7.0% | 10.4% | (341)bps |

Group adjusted operating profit2 | £177m | £258m | (31.5)% |

Group adjusted operating profit2 margin % | 6.4% | 9.8% | (334)bps |

Adjusted diluted EPS2 | 7.2p | 13.7p | (47.9)% |

Group post-tax free cash flow3 | £51m | £73m | (29.5)% |

Net debt4 | £859m | £788m | 9.1% |

Ordinary dividend5 | 3.5p | 5.3p | (34.0)% |

|

|

|

|

Statutory measures | H1 FY26 | H1 FY25 | Change |

Group operating profit | £149m | £235m | (36.8)% |

Group operating profit margin % | 5.4% | 8.9% | (349)bps |

Group profit before tax | £75m | £169m | (55.6)% |

Statutory diluted EPS | 5.2p | 12.3p | (57.4)% |

Group cash generated from operations | £293m | £303m | (3.0)% |

Highlights

- Group revenues increased by 4.0% to £2,749m (+3.9% constant currency6) driven by total value and volume growth in both B&M businesses

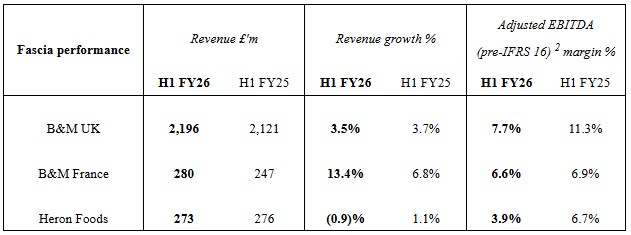

- B&M UK7 total sales growth in the first half of 3.5% with LFL1 sales up 0.1%, with positive volume and value LFL sales in General Merchandise offset by a decline in FMCG LFL sales

- 31 gross and 15 net new stores opened across the Group in H1 (23 gross, 9 net in B&M UK; 5 gross, 5 net in B&M France; 3 gross, 1 net in Heron)

- Group adjusted EBITDA (pre-IFRS 16)2 of £191m down 30.2% (H1 FY25: £274m), with a margin of 7.0% (H1 FY25: 10.4%)

- Group adjusted operating profit2 of £177m (H1 FY25: £258m), with statutory operating profit of £149m (H1 FY25: £235m) and statutory profit before tax of £75m (H1 FY25: £169m)

- Post-tax free cash flow3 of £51m (H1 FY25: £73m), reflecting working capital outflows as inventory builds ahead of the Golden Quarter and continued investment in our new stores and infrastructure

- Redomicile process is expected to complete in the new calendar year and will enable share buybacks, which the Board has confirmed as its preferred option for returning excess capital, once shareholder approvals are in place

- Interim dividend of 3.5p5 per Ordinary Share will be paid on 12 December 2025 to shareholders who are on the register at close of business on 21 November 2025 (H1 FY25: 5.3p)

- Net debt4 to last-twelve-months adjusted EBITDA (pre-IFRS 16)2 leverage ratio of 1.6x (H1 FY25: 1.2x). Incorporating IFRS 16, net debt to last twelve-months adjusted EBITDA2 was 2.9x (H1 FY25: 2.5x)

- B&M UK LFL1 trading in early Q3 has been at the lower end of the 'low single-digit positive to low single-digit negative' percentage assumption range we outlined on 7 October 2025. However, with the majority of the key Golden Quarter trading period still ahead, we reiterate our guidance range for FY26 Group adjusted EBITDA (pre-IFRS 16) 2 of £470m-£520m

Download the full publication here

Chief Executive's Review

This is my first presentation of Interim Results for the Group in my role as Chief Executive. The period coincides with a comprehensive review of operating performance, which I led shortly after being appointed as CEO in June 2025. It was clear to me that B&M's business fundamentals were solid, but I saw immediate opportunities to improve our retail execution and strengthen our customer proposition. We have since devised clear actions to seize these opportunities in a growth plan we call Back to B&M Basics, the details of which I set out below.

We announced on 20 October that following a system integration change, freight costs had not been correctly recognised. While the error did not impact any audited historical financial information, it did impact assumptions that determined our 7 October Trading Update and outlook. The Board commissioned a review of the matter, which is being conducted by EY. We expect the review to be completed in the coming weeks and we will update further at our Q3 Trading Update in January 2026.

The Board has decided that, while the Company's redomicile from Luxembourg to Jersey remains a priority to provide increased flexibility in returning excess capital to shareholders, it should be completed once the review has concluded and any appropriate actions have been taken. The Board is confident that the redomicile will complete in the new calendar year and will enable excess capital to be returned by way of share buybacks, subject to shareholder approvals.

As we set out in our Trading Update on 7 October, new store openings and good trading momentum in B&M France enabled the Group to grow revenue by 4.0% during the first half of FY26. B&M UK1 revenue grew by 3.5% as we opened 9 net new stores, which contributed to total value and volume sales growth. B&M UK LFL2 sales meanwhile were broadly flat (+0.1%), with volume and value growth in General Merchandise offset by a decline in FMCG LFL sales.

We are taking decisive actions to correct the weakness in LFL sales with our Back to B&M Basics plan. We believe the full impact of these actions will take 12-18 months to take effect, but we are confident they will restore B&M's value proposition and support a return to sustainable LFL sales growth for B&M UK.

The UK consumer remains under pressure from cost-of-living concerns and fiscal uncertainty, the impact of which is reflected in our recent trading. For B&M UK, this has been at the lower end of the low single-digit positive to low single-digit negative percentage assumption range we outlined on 7 October. Our Back to B&M Basics initiatives are also in their early stages. However, with the main portion of the important Golden Quarter still ahead of us, we maintain our guidance of a second-half UK LFL percentage growth rate of between low single-digit negative and low single-digit positive levels. We expect B&M UK's LFL2 sales will be the principal driver of the outcome of FY26 Group adjusted EBITDA (pre-IFRS 16)3 within our guidance range of £470m-£520m.

We expect that our actions under Back to B&M Basics will support a return to LFL growth over the next 12-18 months, enabling future adjusted EBITDA margins for B&M UK to stabilise at low double-digit percentage levels over the medium term as an outcome.

Back to B&M Basics

B&M's original customer proposition remains strong, but our execution has drifted. This has impacted our trading performance, which our first half results reflect. Outlined alongside our 7 October Trading Update, our Back to B&M Basics plan is a set of immediate actions to bring about improvements in four key areas of our retail execution: Price, Promotions, Ranges, and on-shelf Availability. Our number one priority is to return B&M UK to sustainable LFL growth.

We have moved at pace to implement this plan, with actions ongoing or planned in these four key areas, including:

Adjusting prices on FMCG Key Value Items ('KVIs') to sharpen our customer value proposition. While our blended FMCG basket has remained around 15% cheaper than mainline grocers (including loyalty) and we have been price competitive versus the discount retailers, we need to be consistently more competitive on price on individual lines. We have therefore cut prices on 35% of our KVIs, lowering the average KVI line price by 1.8%. This move will help drive our price perception with customers over time.

With this new line-based benchmarking in place, we are now expanding the number of peers we compare our prices against and, over time, will extend this methodology to our General Merchandise ranges.

Rebooting our 'Managers Specials' promotions, which became too static and duplicative, to bring excitement and outstanding value back to our front-of-store bays. Store managers are now free to select the best lines within a broad framework in response to their local markets, starting with our Back-to-School ranges in September and Halloween in September/October, both of which have traded well.

We are now implementing this refreshed approach across our UK estate and plan to develop and apply customer analytics capabilities to help configure and direct our wider promotional activities in support of driving average transaction volumes higher.

Refocusing our ranges to reduce line count and accelerate the clearance of discontinued ranges, particularly in FMCG, home accessories and toys ranges, following a material increase in SKUs in recent years that has introduced complexity for our customers and our operations.

The first three FMCG category pilots are now underway in 22 stores, the results of which will inform the rollout across all FMCG categories in the entire UK estate during Q4 FY26 and Q1 FY27, with the same approach planned for our General Merchandise categories thereafter.

Restoring product on-shelf availability, which is below industry FMCG benchmarks, resulting in an estimated 86% FMCG best seller availability across key stores versus best practice standards of 98%. We found that our emphasis on store presentation prioritised the look of a full shelf over actual stock availability of products customers want. Supported by better replenishment processes and simpler ranges, our stores will now be focused on ensuring our most popular products are always available to our customers, in order to drive sales performance.

A 'best sellers' pilot capturing approximately 240 of our most popular FMCG SKUs is now underway in 11 stores ahead of a full store rollout scheduled for Q3 FY26. An adapted replenishment process is under development, with a pilot implementation scheduled for Q4 FY26. Longer term, we are evaluating AI-enabled transaction monitoring to deepen our capabilities in maximising on-shelf availability.

Strengthening our Foundations

Back to B&M Basics is Phase One of a longer-term strategy to first restore - and then accelerate - growth across our business. A similar set of actions are ongoing at Heron to strengthen LFL growth.

Beyond B&M Basics, we have valuable opportunities to deepen B&M's foundations in order to support future growth. This is Phase Two, which will include smarter use of data and customer insights and simplifying many of our in-store processes, which are overly complex. It will also see us flex the format of our stores to best suit their location - especially town centre sites where the customer shop can vary - and ensure our in-store experience for customers is one that deepens their loyalty to the B&M brand.

With these foundations in place, we also see a Phase Three opportunity to accelerate growth by investing in the success of B&M France. This business has been executing well in a competitive market and enjoyed double-digit growth in Q2. In addition, we will be investigating longer-term opportunities, including private label and potentially ecommerce and loyalty programs. We will provide an update on these opportunities as we evaluate and reach decisions on each.

Priorities and Opportunities

B&M's fundamentals remain strong, but our execution needs improvement. We have completed a full diagnosis of where we drifted from our core value proposition and have a plan underway to return B&M UK to sustainable LFL growth. This is the first phase of a longer-term plan that is about fixing the basics before deepening our foundations and, finally, accelerating our growth.

Our number one priority is returning B&M UK to LFL growth, which we believe will enable our UK EBITDA margin to stabilise at low-double-digit percentage levels in the medium term as an outcome. In the meantime, we continue to apply the same financial discipline to growth opportunities to drive the strong returns on investment and cash generation that are hallmarks of our earnings model.

Source : B&M European Value Retail S.A.

Image : B&M European Value Retail S.A.

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.