UK DIY News

BRC: Food Inflation Rises For Fourth Consecutive Month

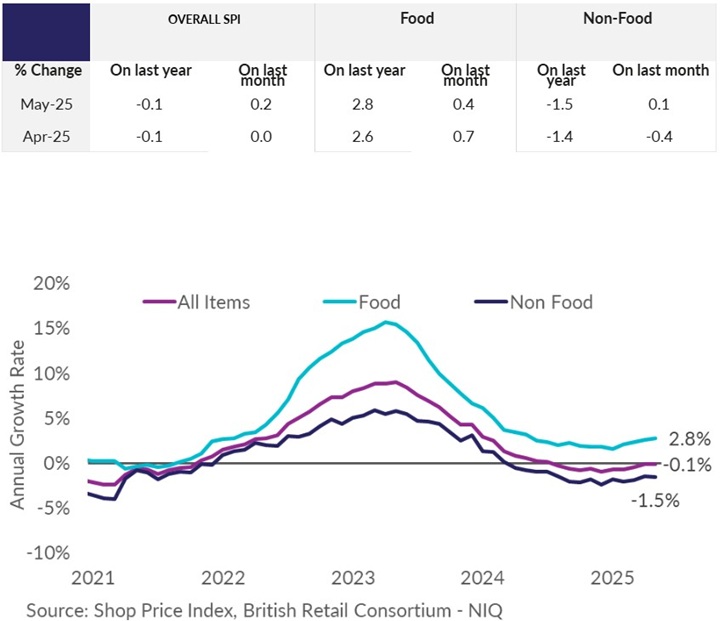

The BRC has published shop price inflation/deflation data for the period 01 – 07 May 2025.

Key points:

- Shop price deflation was unchanged at 0.1% year on year in May, against a decline of 0.1% in April. This is above the 3-month average of -0.2%.

- Non-Food deflation decreased to 1.5% year on year in May, against a decline of 1.4% in April. This is above the 3-month average of -1.6%.

- Food inflation increased to 2.8% year on year in May, against growth of 2.6% in April. This is above the 3-month average of 2.6%.

- Fresh Food inflation increased to 2.4% year on year in May, against growth of 1.8% in April. This is above the 3-month average of 1.8%.

- Ambient Food inflation decreased to 3.3% year on year in May, against growth of 3.7% in April. This is below the 3-month average of 3.6%.

Helen Dickinson, Chief Executive of the BRC, said:

“While overall shop prices remain unchanged in May, food inflation rose for the fourth consecutive month. Fresh foods were the main driver, and red meat eaters may have noticed their steak got a little more expensive as wholesale beef prices increased. Non-food prices remained in deflation, but this slowed in categories such as fashion and furniture as retailers began to unwind heavy promotional activity. Prices were falling faster for electricals as retailers tried to encourage spending before any potential knock-on impact from U.S. tariffs.”

“With retailers now absorbing the additional £5bn in costs from April’s increased Employer National Insurance contributions and National Living Wage, it is no surprise that inflation is rearing its head once again. Later this year, retailers face another £2bn in costs from the new packaging tax, and there are further employment costs on the horizon from the implementation of the Employment Rights Bill. Government must ensure the Employment Rights Bill is fit for purpose, supporting workers’ rights while protecting jobs and investment for growth. If statutory costs continue to rise for retailers, households will have to brace themselves for more difficult times ahead as prices rise faster.”

Mike Watkins, Head of Retailer and Business Insight, NielsenIQ, said:

“Whilst shoppers are seeing savings at the checkout as retailers increase promotional activity, increasing prices is still an extra challenge to consumer spending alongside rising household bills. And if consumer confidence remain weak as looks likely, then retailers may have to work harder to encourage shoppers to spend over the summer.”

Source : BRC

Image : sergeyryzhov / iStock / 517010420

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.