UK DIY News

Dunelm: 'Solid' First Half Despite Challenging Environment

Dunelm Group plc ("Dunelm" or "the Group"), the UK's leading homewares retailer, today announces its Interim Results for the 26 weeks to 27 December 2025.

Performance

- Solid first half trading, despite a challenging environment

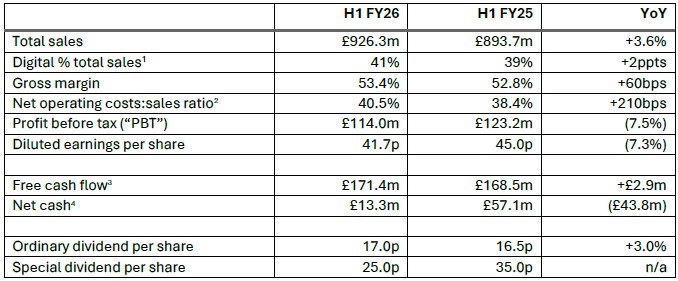

- Sales growth of 3.6%, with total sales increasing to £926m (FY25 H1: £894m)

- Sales growth ahead of the combined homewares and furniture market, with market share up 20bps to 7.9%5 (FY25 H1: 7.7%)

- Digital participation up 2ppts to 41% (FY25 H1: 39%)

- Strong gross margin of 53.4% (FY25 H1: 52.8%), up 60bps largely driven by FX gains

with retail prices held broadly stable - Profit before tax of £114m (FY25 H1: £123m); down year-on-year reflecting the softer trading in Q2 and the timing of certain costs

- Free cash flow of £171m (FY25 H1: £169m); including timing benefit of £93m (FY25 H1: £88m)

- Interim ordinary dividend per share of 17.0 pence (FY25 H1: 16.5 pence), an increase of 3.0%

- Special dividend of 25.0 pence per share (FY25 H1: 35.0 pence)

Current trading and outlook

- Following a softer Q2, we have seen stronger sales growth in Q3 to date, more in line with H1 as a whole

- The consumer environment remains challenging, with variable trading patterns

- We remain confident in our plans for the second half, with the full launch of our app planned for spring and furniture availability recovery plans in place

- We see clear opportunities to build on our strengths with a relentless customer focus, product excellence and retail rigour

- We expect PBT for FY26 to be in line with current consensus expectations6

Clo Moriarty, Chief Executive Officer, commented:

“Since joining Dunelm in October, I’ve been struck by the magic that has turned this very special business from a market stall into a market leader. Dunelm is a universal brand with something for everyone, powered by a compelling combination of physical stores, a growing digital platform, and passionate colleagues who care deeply about delivering for customers.

"We delivered a solid first-half performance despite a softer second quarter, and we are seeing stronger sales growth in early Q3 following a good Winter Sale and an encouraging response to our new Spring ranges.

"What I’ve seen so far gives me real confidence in our future. With only 7.9%5 market share and clear opportunities to enhance and expand our assets, we have significant headroom for growth. We will build on our existing strengths with relentless customer focus, product excellence and retail rigour, underpinned by the financial discipline for which Dunelm is known. There is much more in the tank, and I’m excited for what lies ahead.”

1 Digital includes home delivery, Click & Collect orders and tablet-based sales in store

2 Net operating costs are defined as operating costs net of other operating income. Other operating income includes rental and insurance income

3 Free cash flow is defined as net cash generated from operating activities less capex (net of disposals), net interest paid (including leases) and loan transaction costs, and repayment of principal element of lease liabilities. A reconciliation of operating profit to free cash flow is included in the CFO review. Free cash flow in the half included a timing benefit of £93m (FY25 H1: £88m) due to a payment in transit which cleared on the second working day of H2

4 Cash and cash equivalents less total borrowings, excluding transaction costs (as shown in note 16). Excludes IFRS 16 lease liabilities

5 Market share of the combined UK homewares and furniture markets (excluding kitchen cabinetry, bathroom furniture and decorative DIY) as reported by GlobalData UK for the period January to December 2025. Market share for 2024 was 7.7% (restated from 7.8%)

6 Company compiled average of analysts’ expectations for FY26 PBT is £214m, with a range of £210m to £221m

Source : Dunelm

Image : Dunelm

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.