UK DIY News

Ferguson Delivers Strong First Half

Ferguson plc has reported on trading for the half year ended January 31, 2021.

Highlights

Highlights

− Strong operational delivery in the first half:

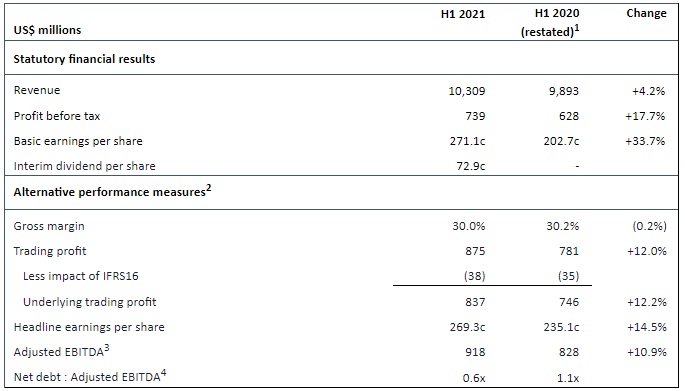

o Revenue 4.2% ahead of last year, despite one fewer trading day.

o Gross margin down 0.2% driven by business and channel mix.

o Excellent cost control ensured good underlying trading profit delivery up 12.2%, or $91 million.

o Good operating cash generation and very strong balance sheet with 1.0x pro-forma leverage5.

− Invested $224 million primarily in four acquisitions in the first half.

− UK disposal completed in the period. Special dividend of 180 cents per share (approximately $400 million) will be paid in May 2021.

− Interim dividend increased to 72.9c per share, will be paid in May 2021.

− New $400 million share buy back announced today.

− Additional US listing delivered and trading commenced on the New York Stock Exchange on March 8, 2021.

1) The Group disposed of its UK operations on January 29, 2021. Pursuant to IFRS requirements, the UK results have been reclassified to discontinued operations and the prior year comparative results have been restated.

2) The Group uses Alternative Performance Measures ("APMs"), which are not defined or specified under IFRS, to provide additional helpful information. These measures are not considered to be a substitute for IFRS measures and are consistent with how business performance is planned, reported and assessed internally by management and the Board. For further information on APMs, including a description of our policy, purpose, definitions and reconciliations to equivalent IFRS statutory measures see note 2.

3) Continuing operations only, excludes the impact of IFRS16. Adjusted EBITDA contribution from discontinued operations in the period was $57 million (2020 restated: $48 million)

4) Net debt excludes lease liabilities and Adjusted EBITDA excludes the impact of IFRS 16. Leverage ratio utilizes a trailing twelve months adjusted EBITDA for both continuing and discontinued operations.

5) Pro-forma net debt adjusted to include the impact of $400 million special dividend and $400 million share buy back.

Kevin Murphy, Group Chief Executive, commented:

"Ferguson delivered good top-line growth in the first half and despite challenging personal and professional circumstances, our associates continued to deliver for our customers. We continued to carefully manage the cost base to ensure excellent profit growth and solid cash flow generation. We remain confident in our strategy and are optimistic about our prospects in 2021 and beyond.

"Since the start of the third quarter, we have continued to trade well, generating high single digit organic revenue growth. While the outlook for the second half remains very uncertain, we expect to generate above market revenue growth in good residential markets aided by increasing inflation. However, we expect this to be partially offset by increasing supply chain pressures, transportation costs and the reversal of temporary cost reduction actions taken during the initial stages of the lockdown starting in April of last year. We are well positioned to manage through this environment and we will continue to invest in talented associates and digital capabilities to serve our customers and take advantage of market opportunities."

Source : Ferguson

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.