International DIY News

Flat Market Impacts Kingfisher Poland; Strong Iberian Growth

Kingfisher has published half year results for the six months ended 31 July 2025 (unaudited).

Poland

Market

- Market broadly flat, with political factors, elevated inflation and interest rates weighing on consumer demand in H1.

- Signs of recovery with falling inflation, real wage growth, interest rate cuts and improvement in consumer confidence.

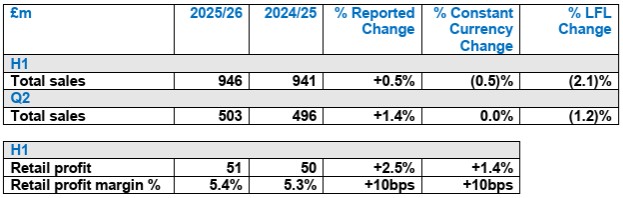

Poland sales

- Total sales -0.5% (LFL -2.1%) to £946m, reflecting a challenging market backdrop with performance broadly in line with the market (as measured by GfK).

- The decline was driven primarily by volume, partially offset by a favourable mix impact.

- Underlying core category sales returned to growth in Q2, following a soft performance in Q1 due to market weakness. Underlying ‘big-ticket’ sales were positive for the half driven by strong customer demand for new kitchen ranges. Seasonal category LFL sales were impacted by unfavourable weather during the half, as Poland experienced an unusually cold spring and summer.

- Q2 saw a sequential improvement versus Q1 broadly reflecting overall market trends. - E-commerce sales increased by 18.9% YoY to £41m, benefiting from positive early results from its marketplace (launched in Jan 25) with marketplace e-commerce penetration reaching 11.4% at H1.

- The business continues to focus on expanding its trade customer proposition through further rollout of ‘CastoPro’ zones within its stores, specialised sales partners and the development of a dedicated mobile app for trade. The trade app has seen 170k downloads since launch. This has helped trade penetration reach 25.2% at H1 (H1 24/25: 15.6%).

- Space growth contributed c.1.6% to total Poland sales from store openings in the prior year. Castorama has a total 107 stores in Poland as of 31 July.

Poland Retail profit

- Gross margin increased by 10 basis points, reflecting the effective management of product costs, supplier negotiations and lower stock provisions driven by better inventory management. This is partially offset by increased promotional activity and mix (category and channel).

- Operating costs decreased by 0.5% with increases in staff pay offset by our structural cost reduction programme, and the flexing of staff levels and discretionary spend.

- Retail profit increased by 1.4% to £51m (H1 24/25: £50m, at reported rates). Retail profit margin % increased by 10 basis points to 5.4% (H1 24/25: 5.3%, at reported rates).

Other International

The ‘Other International’ segment consists of businesses and operating segments that do not meet the quantitative thresholds to be separate reportable segments under IFRS 8.

± ‘Screwfix France & Other ’ consists of the consolidated results of Screwfix International, and results from franchise and wholesale agreements. The prior year comparator includes NeedHelp – we divested our c.80% equity interest on 18 July 2024. **On 2 May 2025 the Group completed the divestment of its 100% equity interest in Brico Dépôt Romania. The Group recognised a £31m loss on disposal (included in adjusting items) as at H1.

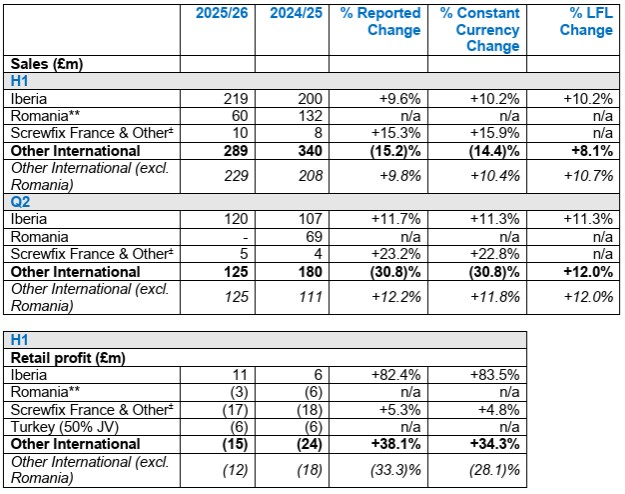

Iberia

- Sales increased by +10.2% (LFL +10.2%) to £219m, with positive LFL sales in core, ‘big-ticket’ and seasonal categories, driven by an improved customer offering, enhanced ranges and leading price positioning in key categories. Growth was also supported by strong demand in Valencia following last year’s flood damage.

- Market share gains in Spain as per AECOC panel.

- Progress in trade with penetration rising to 17.6% (H1 24/25: 15.8%), while the e-commerce marketplace continued to scale, reaching 27.6% of online sales in H1.

- Retail profit increased to £11m (H1 24/25: £6m, at reported rates), reflecting higher gross profit, and improved operating cost leverage.

Screwfix France & Other

- ‘Screwfix France & Other’ includes Screwfix France, and results from franchise and wholesale agreements.

- Screwfix remains focused on building brand awareness in northern France (25% at H1, +7pts YoY) and enhancing its customer proposition through Screwfix Sprint, trade brands and trade-focused campaigns. Store LFL sales grew +52% (3).

- Screwfix had a total of 30 stores in operation in France as of 31 July 2025 (H1 2024/25: 25). Targeting up to 5 store openings in FY 25/26.

- We currently have seven partners operating in EMEA which are buying selected Own Exclusive Brand (OEB) products, including Altex in Romania following their purchase of Brico Dépôt Romania.

- Combined retail loss of £17m in line with expectations (H1 24/25: £18m reported retail loss).

Turkey

- Total contribution to Group adjusted PBT was a net loss of £9m (H1 24/25: £13m).

- LFL sales were negative in H1, but improved over the period.

- Improvement in net loss was driven by gross margin and cost efficiency initiatives, as well as a reduced impact from hyperinflation accounting.

- Koçtaş’s comprehensive restructuring programme – including significant headcount reductions, closure of loss-making stores, and rightsizing – has also begun to contribute to operational performance. As of 30 June 2025, the store count stood at 205, down from 369 in H1 24/25.

Romania

- On 2 May 2025 the Group completed the divestment of its 100% equity interest in Brico Dépôt Romania for proceeds of £53m. The Group recognised a £31m loss on disposal (included in adjusting items) as at H1.

Source : Kingfisher plc

Image : Kingfisher plc

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.