UK DIY News

Headlam: Good Transformation Plan Progress Amid Challenging Market

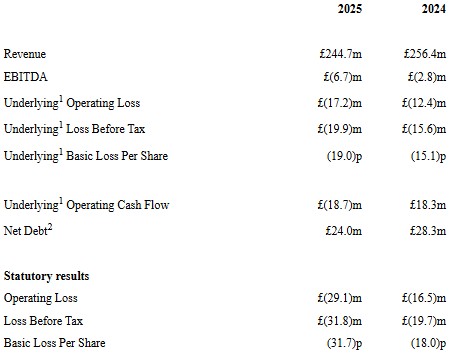

Headlam Group plc (LSE: HEAD), the UK's leading floorcoverings distributor, today announces its results in respect of the first six months of the year to 30 June 2025.

All income statement and cash flow numbers presented above are for continuing operations unless otherwise stated. The Continental European businesses are presented as discontinued operations

H1 results reflect continued challenging market conditions

- Revenue declined 3.8% year-on-year on a same-day basis

- Gross margin slightly up year-on-year at 30.8% (H1 2024: 30.4%)

- Operating costs well controlled, with early benefits from the transformation plan more than offsetting inflationary pressures including national minimum wage and the increase in NI contributions

- Underlying Loss Before Tax of £19.9m reflecting the cumulative decline in the flooring market

Strong balance sheet; working capital well-controlled

- Stock levels are £12m lower than the same period last year although higher than December 2024. The H1 increase reflects targeted investments to improve stock availability and support revenue recovery. Our recently centralised buying processes are expected to reduce stock levels in the second half of the year

- Net Debt of £24m at the end of the Period compared to £28m a year ago

- £47.5m of cash and undrawn facilities at the end of the Period; £21m cash receipts from property sale since the Period end, reducing Net Debt further

- Strong asset backing: at the end of the Period the Group owned property valued in 2023 at £94m; recent disposals have been at an average 23% premium to these valuations

Good progress on implementation of transformation plan; upgraded benefits

- In September 2024 the Group announced a transformation plan to simplify its customer offer, network and operations

- The objectives of this plan are to: improve profitability, increase market share and release cash through more efficient working capital management and the disposal of non-core property

- The market conditions have been weaker, and for longer, than previously expected. Accordingly, during the Period the Group selected Alvarez & Marsal to assist the Group in accelerating and increasing the scale of benefits from the transformation plan initiatives, with an initial focus on helping implement a revised supplier sourcing strategy and centralised buying function

- Good progress has been made so far, including the following developments during 2025:

- Commencement of the rollout of innovative new display stands, supporting our independent retailer customers

- Network optimisation in the South East with the opening of a new distribution centre in Rayleigh and the closure of the Ipswich site

- Consolidation of operations in the Midlands, with Nottingham transferred into other sites

- The launch of fully centralised buying processes in Jun

- The commencement of the supplier sourcing strategy, including harmonisation of ranges

- Preparation for sale of the Group's businesses in France and Netherlands

- As a result of the preparatory work performed to date, and the additional initiatives identified, we upgrade the annual profit improvement expected from the transformation plan from the previous guidance of £25m to at least £35m; the majority of this cumulative profit benefit is expected to have been delivered by the end of 2026. In 2025, we anticipate at least £10m profit benefit from the transformation plan.

Current trading and outlook

- The lead indicators for the market continue to point to a return to growth over the medium term, but the timing of market recovery continues to be uncertain and volatile, and market data indicates a slight deterioration in market conditions in the last three months

- The Group's year-on-year revenue for July was similar to June, with the two months close to flat year-on-year with August slightly weaker

- As we move into Q4, the market shifts into the peak residential trading period and the Group annualises relatively softer comparatives; accordingly, we anticipate a continuation of the improving revenue trajectory observed during the first half

- The transformation plan is progressing well, with benefits starting to take effect in H1 2025 and accelerating through H2 2025 and 2026

- The long-term outlook for Headlam remains positive, reflecting the combination of:

- Continued implementation of the existing strategy, including the maturity of the Trade Counter business, with the investment phase now complete

- The transformation plan

- Market improvement, recognising that the market has declined more than 25% in volume terms in recent years

Commenting, Chris Payne, Chief Executive, said:

"We have made good progress on the transformation plan so far, significantly simplifying the Group and its infrastructure and processes. The benefits have started to be realised towards the end of the first half and will accelerate through the second half of the year. Whilst the lead indicators for consumer spending on home improvements are more positive, the flooring market has continued to decline, and the timing of recovery remains uncertain. Against this backdrop we have identified additional benefits from the transformation plan, to offset the market weakness as we continue to drive the Group back to profit. As we unlock cash and costs from our business, we continue to invest in the proposition across all our customer groups in order to grow market share and strengthen our position as the UK's leading floor coverings distributor."

Chief Executive's Review

Introduction and market update

The Group's financial performance in the first half of 2025 continued to reflect the ongoing challenging trading environment. The flooring market declined further during the first half of the year, alongside consumer spending on the broader home improvements category. Cumulatively the flooring market has declined more than 25% in recent years.

Despite the weak market backdrop, we saw an improvement during the first half, albeit with revenues remaining in decline. Group revenue declined 6.6% in January, improving to a 0.6% decline in June.

The transformation plan announced last year is progressing well, thanks to huge efforts from colleagues across the Group. Several initiatives have been implemented already and the benefits from the programme are expected to accelerate from H2 2025 onwards. Through a combination of increased confidence over the scale of benefits from existing initiatives, plus the identification of new initiatives, we have upgraded the overall profit benefits expected from £25 million to £35 million.

Financial and operational performance in H1 2025

Group revenue was down 3.8% year-on-year (on a same working day basis) at £244.7 million (H1 2024: £256.4 million); UK revenue declined by 3.8% and Continental Europe declined by 3.9%. We continued to grow revenues in our Trade Counters and Larger Customers channels, partially offsetting the impact on our core business of market weakness in the UK, France and Netherlands.

During the Period we invested in our Regional Distribution business, including a substantial rollout of display stands to our independent retailer customers, to position the business well as market conditions improve. We have also continued to selectively launch new ranges, maintaining a fresh portfolio of products.

We have now completed our rollout investments in the Trade Counters business which, after some optimisation in the second half, will result in around 80 sites operational at the end of the year. Our Trade Counter business now moves from rollout to maturation phase; so from 2026 onwards, growth in Trade Counter revenue will drop through to profit at a greater rate, leveraging the fixed cost already in place.

Gross margin was slightly up in the Period, despite competitive pricing activity in the market, and operating costs were well controlled. Inflationary pressures on costs, including the 6.7% increase in the National Minimum Wage and the increase in employer's National Insurance Contributions, were more than offset by cost savings and efficiencies. The net operating cost increase of £2.2 million (2.4%) in the first half reflected the final rollout investments in the Trade Counter business.

The Underlying Loss Before Tax of £19.9 million (H1 2024: £15.6 million) for the first half principally reflects the cumulative market decline over recent years. We are addressing the impact of this on the Group's profitability through the transformation plan, which is targeted to deliver at least £35 million of profit improvement upon completion. We continue to assess opportunities to increase the overall benefits further.

Net Debt reduced slightly to £24.0 million at 30th June 2025 compared to £28.3 million at 30th June 2024. The Group had £47.5 million of cash and undrawn facilities available at the end of the Period and, subsequent to the Period end, has received £21.1 million of cash proceeds (excluding VAT) from the disposal of property.

Revenue

Total revenue in the Period decreased by 3.8% on a same working day basis to £244.7 million (H1 2024: £256.4 million). This excludes revenue in Continental Europe which has been presented as a discontinued operation2.

UK

In the UK, we have three main sales channels: Regional Distribution, Trade Counters and Larger Customers. Following the simplification of the Group, integration of sales teams, and the launch of customer initiatives such as "order anywhere, collect anywhere", there is increased crossover of revenues between these sales channels, particularly Regional Distribution and Trade Counters; accordingly, we show UK revenue in total rather than split into channels.

We continued to grow revenue in the Trade Counters and Larger Customers channels; this was offset by revenue decline in Regional Distribution.

We have now completed the rollout phase of the Trade Counters business, with the investments to date performing in line with business case. This business now moves to maturation phase, with revenue growth dropping through to profit at a greater rate, reflecting that the fixed cost will already be in place.

Revenue from Larger Customers continued to grow, despite the loss of Homebase as a customer (which generated £6.8 million revenue in full year 2024), reflecting increased share of business of existing customers, combined with the annualisation of customers won in H2 2024.

Continental Europe

Revenue declined 3.9% in Continental Europe; the net of growth in the Netherlands, reflecting new distribution agreements for exclusive supply of certain branded ranges, and decline in France due to ongoing market weakness. The revenue performance improved during the Period.

Gross Margin

Gross margin in the Period was 30.8% (H1 2024: 30.4%). This reflected the net of lower stock clearance activity in the current year, partially offset by the impact of mix.

Costs

Operating costs increased by 2.4% to £92.5 million (H1 2024: £90.3 million). Cost inflation has remained elevated, albeit to a lower extent than previous years, driven by the 6.7% increase in the national minimum wage and the increase in employer's National Insurance contributions. These inflationary headwinds were more than offset by cost savings and efficiencies from the transformation plan, albeit total operating costs increased as a result of the final stage of the rollout of new sites in our Trade Counters business which added over £3 million of additional operating costs.

Underlying Profit/Loss

Underlying Loss Before Tax of £19.9 million compared to a loss of £15.6 million in H1 2024.

Source : Headlam Group plc

Image : Headlam Group plc

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.