UK DIY News

Kingfisher: Group Sales Slightly Ahead Of Expectations

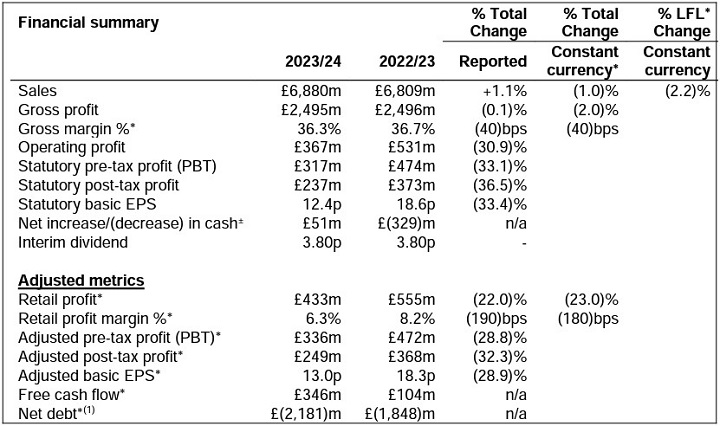

Kingfisher plc has published unaudited half year results for the six months ended 31 July 2023.

For Kingfisher's International results, click here

± Net increase/(decrease) in cash and cash equivalents and bank overdrafts

± Net increase/(decrease) in cash and cash equivalents and bank overdrafts

Highlights

- Group H1 sales slightly ahead of expectations. Total sales -1.0% and LFL -2.2%, with Q2 LFL -1.2% accelerating from Q1 (LFL -3.3%)

- Sales by region:

- Positive UK & Ireland performance (LFL +1.7%) with strong market share gains at Screwfix

- France (LFL -3.8%) saw resilient performance at Castorama; weaker at Brico Dépôt

- Poland (LFL -10.9%) impacted by strong comparatives and weaker than expected Q2

- Sales by category:

- Resilient core and 'big-ticket' category sales LFL -1.0% (78% of sales), with volumes showing an improving trend through H1

- Seasonal sales LFL -5.9% (22% of sales), with sequential improvement in Q2 driven by better UK weather conditions in May and June

- Continuing to invest in our strategic priorities, including e-commerce and marketplace, data and retail media, developing our trade proposition, and Screwfix

- H1 adjusted PBT down 28.8% to £336m, with UK & Ireland and France slightly ahead of expectations (the latter due to good cost control), more than offset by lower than expected Poland performance. Statutory PBT down 33.1% to £317m

- FY adjusted PBT guidance: Q3 LFL to date -2.4%. Reflecting H1 results and the trading environment in our markets, updating our full year adjusted PBT guidance to c.£590m (previously c.£634m)

- Continue to expect >£500m free cash flow for the year, underpinning attractive shareholder returns with over £260m returned in H1. Announcing today a new £300m share buyback programme

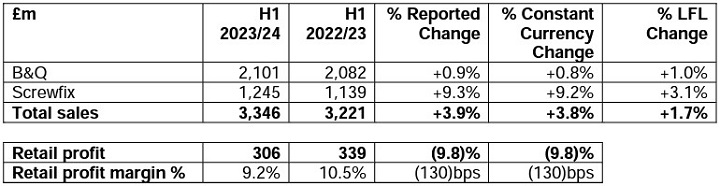

Kingfisher UK & Ireland

Kingfisher UK & Ireland sales increased by 3.8% (LFL +1.7%) to £3,346m. The LFL sales trend accelerated from -0.8% in Q1 to +4.1% in Q2, supported by a significant improvement in seasonal category sales due to more favourable weather in May and June, although momentum was affected by unseasonal weather in July. Core and ‘big-ticket’ category sales were also positive, and accelerated from Q1, supported by an improving volume trend. A resilient performance in DIY categories was outpaced by sales from DIFM/trade categories, with Screwfix gaining significant market share in H1. Gross margin % was flat versus prior year, reflecting the effective management of inflation and favourable channel mix impacts, offset by higher clearance costs and stock provisions. Positive channel mix reflects the strong growth of B&Q’s e-commerce marketplace.

Retail profit decreased by 9.8% to £306m (H1 22/23: £339m, at reported rates), due to higher operating costs. Operating costs increased by 8.9%, driven by cost inflation, including YoY increases in staff and energy costs, higher technology spend, and higher costs associated with 59 net new store openings (YoY). Cost increases were partially offset through reductions achieved by our strategic cost reduction programme. Retail profit margin % decreased by 130 basis points to 9.2% (H1 22/23: 10.5%).

B&Q total sales increased by 0.8% (LFL +1.0%) to £2,101m, with LFL sales growth in its surfaces & décor and tools & hardware categories. Sales trends improved significantly in Q2 (LFL +3.3% vs Q1 1.6%), supported by strong seasonal category sales in May and June. Core and ‘big-ticket’ category sales growth were positive in both Q1 and Q2, with an acceleration from Q1 supported by an improving volume trend. B&Q’s total e-commerce sales (including marketplace gross sales) increased by 18.5% YoY, driven by the continued success of B&Q’s marketplace as it attracts new customers to diy.com. Marketplace reached a penetration of 33% in July 2023 (i.e., B&Q’s marketplace gross sales divided by B&Q’s total ecommerce sales). B&Q’s overall e-commerce sales penetration was 12% (H1 22/23: 11%; H1 19/20: 5%). The business opened one small retail park format store in H1 and closed all eight of its ‘grocery concession’ stores. As of 31 July 2023, B&Q had a total of 309 stores in the UK and Ireland.

B&Q’s trade-focused banner, TradePoint, delivered a good performance in the half against robust prior year comparatives. LFL sales for TradePoint were down 1.8%, with penetration of B&Q sales reducing slightly to 20% (H1 22/23: 21%). Sales were impacted by a proactive decision to switch off trade instant vouchers during ‘big-ticket’ promotional events, in support of profitability and investment in promotions on the retail side of B&Q. Notwithstanding this, TradePoint’s loyalty programme remains attractive to customers, with new sign-ups in H1 increasing by 37% YoY. During the half, the business focused on increasing customer engagement and loyalty through trade-only offers, special events, and enhanced services such as dedicated sales partners for trade customers. TradePoint is also increasingly focused on growing its business-to-business (B2B) sales, catering to trade federations, professional housebuilders and small and medium-sized enterprises, with sales in this area up by over 30% YoY. TradePoint opened 18 new counters in H1, extending its presence within the B&Q store network to 207 stores (67% of stores).

Screwfix total sales increased by 9.2% (LFL +3.1%) to £1,245m, with robust demand from trade customers driving growth in all categories, in particular in building & joinery, tools & hardware and surfaces & décor. Sales trends accelerated in Q2 (LFL +5.6% vs Q1 +0.7%), supported by an uptick in both its core and ‘big-ticket’ categories as well its seasonal categories. The business gained significant market share in the half. Screwfix’s e-commerce sales increased by 3.9% YoY, with e-commerce sales penetration of 58% (H1 22/23: 60%; H1 19/20: 32%). The business continued to build on the success of its mobile app, the fastest growing channel at Screwfix, by running app-only campaigns and integrating personalised and trade-exclusive offers. The app delivered a record performance in the half, including record app revenue in a month and record app participation rates, reaching 2 million monthly active users.

Space growth and acquisitions contributed c.6% to total Screwfix sales. In H1, Screwfix opened 12 new stores, including 10 in the UK and two in Ireland, bringing its total to 884 as of 31 July 2023. The business continues to plan for up to 60 new stores in the UK & Ireland in FY 23/24, keeping it on track to reach its medium-term goal of over 1,000 stores.

In March, the business acquired the stock, intellectual property, contracts and fixed assets of Connect Distribution Services Limited (renamed Screwfix Spares), a leading retailer of appliance spares, accessories and consumables to tradespeople and consumers. Since acquisition, Screwfix Spares has performed in line with expectations, contributing c.1.2% to total Screwfix sales growth. The business expects to accelerate its sales in H2 and start generating profits by the end of the year.

Further progressing its international expansion plans, Screwfix opened four stores in France in H1 (with nine stores open in total), and plans to open up to 20 stores in FY 23/24. Customer momentum is building and the business continues to grow brand awareness, both regionally and nationally. The early results in France have encouraged us to take the next step in Screwfix’s international expansion journey. In Q3, we intend to launch Screwfix as a pure-play online retailer in continental Europe (under the domain name screwfix.eu), serving up to 20 European countries. The results for Screwfix International are captured in ‘Other International’.

Thierry Garnier, Chief Executive Officer, said:

"Our LFL sales in H1 were slightly ahead of expectations, against a backdrop of unseasonal weather and ongoing macroeconomic challenges in our markets. We saw good growth in our UK banners, with Screwfix gaining significant market share. At the same time, we faced strong comparatives and a weaker trading environment in Poland, while consumer confidence in France is at a 10-year low. Overall, demand for our core and 'big-ticket' categories was healthy, and we were pleased to see an improving volume trend in these categories through the half.

"We continue to make strong progress against our strategic priorities. E-commerce sales were up 7% in H1, supported by the continued success of our online marketplaces. B&Q's marketplace sales reached 33% of its e-commerce business in July. We leveraged our data science capabilities to develop AI-powered solutions such as our markdown tool, which in early pilots at B&Q delivered a very encouraging margin improvement on clearance products. We also advanced our retail media plans through new partnerships to accelerate advertising income. And we continued to invest in dedicated ranges, tailored services and expert colleagues to better serve trade customers across all our banners, including launching 'Pro' zones in 27 stores in France and Poland.

"Further, with nine Screwfix stores now open in France including four new stores in H1, customer momentum is building. We are now planning for up to 20 store openings this year. These early results in France have encouraged us to take the next step in our international expansion journey, and we are today announcing the launch of Screwfix in Q3 as a pure-play online retailer in up to 20 European countries.

"Trading in the UK & Ireland continues to have positive momentum. However, to better reflect our performance in H1 and the trading environment in our markets, we have updated our profit guidance for this year and are proactively managing our operating costs accordingly. We remain very positive on the medium-to-long term outlook for home improvement growth in our markets, and confident in our ability to grow market share and deliver on our medium-term financial objectives. Underscoring this confidence, we are today announcing a new £300m share buyback programme, starting in early October."

Source : Kingfisher

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.