UK DIY News

Kingfisher: Trading 'In Line With Expectations'; Big Ticket Demand Remains Weak

Kingfisher has published unaudited half year results for the six months ended 31 July 2024.

For International performance, click here

H1 24/25 highlights

- Overall sales in line with our expectations; market share gains in the UK and Poland

- Total sales -1.4% and LFL -2.4%. Q2 LFL -3.8%

- UK & Ireland (LFL -0.2%) and Poland (LFL -0.2%) both resilient despite weather-impacted seasonal sales; market share gains in all banners

- France sales (LFL -7.2%) broadly in line with the market, reflecting the soft consumer backdrop throughout the period

- Resilient core category sales, supported by repairs, maintenance and existing home renovation activity. Recovery in seasonal sales since early July and weak 'big-ticket' sales as expected - Solid and focused execution against key objectives

- Strong results from our e-commerce marketplace (Group GMV +80.0%) and trade propositions (including TradePoint LFL +7.1%). E-commerce sales penetration now 18.3% (H1 23/24: 16.8%)

- Rapid progress in Castorama France store restructuring and modernisation plan, with works completed or in motion on 13 low-performing stores. Operating costs down 3.0% in France in H1 - Strong management of gross margin, costs and inventory

- Maintaining competitive price indices and disciplined promotional activity in all markets (with gross margin % +40bps); retail price inflation flat YoY

- Fully on track to achieve c.£120m of cost reductions for the full year, weighted towards H1

- Strong management of net inventory, down £134m (4.3%) YoY - Adjusted PBT down 0.5% to £334m, including c.£25m of one-off business rates refunds at B&Q. Statutory PBT up 2.3% to £324m

- Free cash flow of £421m, supported by phasing of inventory purchases over the year

Outlook and guidance

- Current trading: Q3 24/25 LFL sales (to date) (2) -0.3%

- FY 24/25 adjusted PBT: range tightened to c.£510m to £550m(3) (previously c.£490m to £550m)

- FY 24/25 free cash flow: range upgraded to c.£410m to £460m (previously c.£350m to £410m)

- Share buybacks: accelerating pace of current £300m share buyback programme (c.£150m completed to date), now expecting to complete the programme in March 2025

- Strongly positioned for growth in 2025 and beyond: more agile, significant structural cost taken out across the Group, and confidence in multiple profitable growth drivers over the medium term

Thierry Garnier, Chief Executive Officer, said:

"Trading overall in the first half was in line with our expectations. This was underpinned by customers continuing to repair, maintain and renovate their existing homes, driving resilient volume trends in our core product categories. As expected, demand for 'big-ticket' categories has remained weak, in line with the broader market, while seasonal category sales trends have improved since early July. Against this backdrop we maintained a strong focus on effectively managing our costs and inventory.

"Our UK & Ireland banners continued to gain market share, supported by strong e-commerce sales and our progress in addressing trade customer needs. Screwfix delivered positive LFL sales and TradePoint achieved strong LFL sales growth of 7.1%, now representing 22% of B&Q's sales. Sales in France were broadly in line with the market, reflecting the soft consumer backdrop. Notwithstanding this, we are making rapid progress with our actions to simplify the French organisation and improve the performance and profitability of Castorama France over the medium term. In Poland, we gained market share and our sales trend was supported by an improved consumer environment.

"I am proud of the unwavering focus of our teams in executing against our strategic priorities, with two key highlights. First, our e-commerce sales penetration improved by 1.5 points to 18.3% and B&Q's e-commerce marketplace reached a 40% share of its online sales. We have also successfully launched Castorama France's marketplace, with Poland to follow in H2. And second, in trade, we are extending the successes we have seen in the UK to other markets, with trade sales penetration growing strongly in France, Iberia and Poland.

"Reflecting our performance in the first half and our current view of the trading environments in our markets, we have tightened our profit guidance and upgraded our free cash flow guidance for the year. We remain focused on continuing to manage our costs and cash effectively, and driving further market share gains by delivering on our key strategic priorities.

"With positive early signs of a housing market recovery, notably in the UK, Kingfisher is strongly positioned for growth in 2025 and beyond."

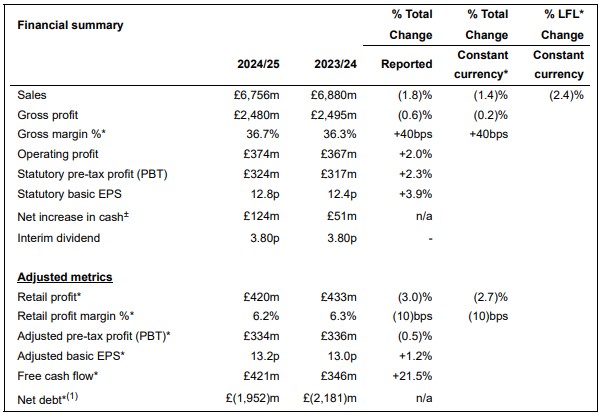

H1 24/25 results summary

- Total sales -1.4% (constant currency) and -1.8% (reported)

- LFL sales -2.4% including a +0.6% leap year impact (4)

- Q2 LFL sales -3.8%, including a -0.5% calendar impact(4)

- Q1 LFL sales -0.9%, including +0.8% calendar impact and +1.1% leap year impact - Sales by region:

- UK & Ireland* LFL -0.2%: market share gains at B&Q supported by strong e-commerce and TradePoint sales; market share gains and positive LFL at Screwfix

- France* LFL -7.2%: reflecting the broader market. Castorama and Brico Dépôt performed broadly in line with market

- Poland LFL -0.2%: sales trend supported by improved consumer environment and trade customer initiatives; performance ahead of the market - Sales by category:

- Core* (64% of sales): continued resilience (LFL -1.1%) driven by repair, maintenance and renovation activity on existing homes

- 'Big-ticket'* (14% of sales): weak sales as expected (LFL -6.8%) reflecting trends across the broader market

- Seasonal* (22% of sales): lower sales (LFL -3.1%) given unfavourable weather conditions across much of April to June - Retail price inflation flat year-on-year (YoY); negative mix impact on average selling price from lower 'bigticket' sales. Overall volume lower YoY, with stable underlying volume trends in core categories between Q1 and Q2

- Total e-commerce sales* +8.4%, driven by growth in the UK & Ireland

- E-commerce sales penetration* of 18.3% (H1 23/24: 16.8%)

- Continued strong growth of e-commerce marketplace sales at B&Q and Brico Dépôt Iberia*; Group marketplace GMV* +80.0% YoY - Gross margin % +40 basis points to 36.7% (H1 23/24: 36.3%) reflecting effective management of product costs, retail prices and supplier negotiations, and lower clearance costs and stock provisions

- Retail profit -2.7% in constant currency to £420m (H1 23/24: £433m), reflecting lower profits in France and higher losses from our joint venture in Turkey; partially offset by higher profits in the UK & Ireland and Poland

- Statutory PBT +2.3% to £324m (H1 23/24: £317m), reflecting higher operating profit (including lower adjusting items* YoY)

- Adjusted PBT -0.5% to £334m (H1 23/24: £336m), reflecting lower retail profit, largely offset by lower central costs* and share of JV interest and tax

- Free cash flow of £421m, up £75m (H1 23/24: £346m), reflecting working capital inflow and lower capital expenditure

- Net increase in cash of £124m (H1 23/24: £51m), reflecting higher free cash flow

- Net debt down to £1,952m (31 January 2024: £2,116m), including £2,324m of lease liabilities under IFRS 16 (31 January 2024: £2,367m), reflecting the net increase in cash. Net debt to last twelve months' EBITDA* of 1.5x (31 January 2024: 1.6x)

- Interim dividend per share declared of 3.80p (FY 23/24 interim dividend: 3.80p)

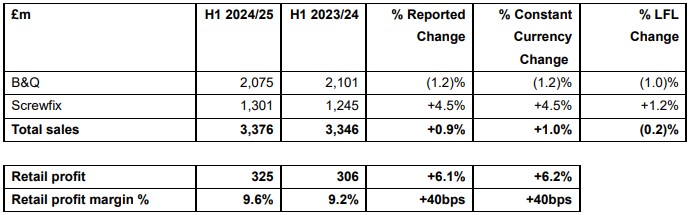

UK & IRELAND

UK & Ireland sales increased by 1.0% (LFL -0.2%) to £3,376m, supported by strong e-commerce performance and our progress in addressing trade customer needs. Core categories (68% of sales) achieved positive LFL sales growth, up 1.4%, with resilient underlying volume trends driven by repairs, maintenance and existing home renovation activity. Sales of seasonal categories (slightly down YoY) were impacted by unfavourable weather patterns from April to June, before recovering in July. As expected, sales in 'big-ticket' categories (i.e., kitchen and bathroom & storage) remained weak. Overall, B&Q, TradePoint and Screwfix all grew faster than their respective markets in H1 (as measured by BRC, Barclays and GfK). Gross margin % increased by 50 basis points, reflecting effective management of product costs, retail prices and supplier negotiations, and a favourable sales mix within Screwfix.

Retail profit increased by 6.2% to £325m (H1 23/24: £306m, at reported rates), reflecting higher gross profit, partially offset by slightly higher operating costs* (up 1.0%, net of c.£25m of one-off business rates refunds at B&Q related to prior years). Excluding business rates refunds at B&Q, operating cost increases were driven by YoY increases in staff costs and higher costs associated with 54 net new store openings (YoY). Cost increases were partially offset by structural savings achieved by our cost reduction programme. Retail profit margin % increased by 40 basis points to 9.6% (H1 23/24: 9.2%).

B&Q total sales decreased by 1.2% (LFL -1.0%) to £2,075m, with positive LFL sales growth in core categories and resilient seasonal sales more than offset by weakness in 'big-ticket'. Underlying sales trends (i.e., excluding calendar and leap year impacts) in core and 'big-ticket' categories were consistent across Q1 and Q2, while sales of seasonal categories slowed (Q2 -2.4% vs Q1 +2.7%). Within our core and seasonal categories, we achieved positive LFL sales growth in building & joinery, tools & hardware, surfaces & décor and outdoor, partially offset by weather-related weakness in EPHC (electricals, plumbing, heating & cooling). B&Q's total e-commerce sales increased by 18.3% YoY, driven by the continued strong performance of B&Q's marketplace which reached an online sales penetration of 41% in Q2 (i.e., B&Q's marketplace gross sales* divided by B&Q's total ecommerce sales). B&Q's e-commerce sales penetration moved up to 14% (H1 23/24: 12%; H1 19/20: 5%). The business closed one big-box and one medium-box (small retail park) store in H1 following the expiry of their respective leases. As of 31 July, B&Q had a total of 309 stores in the UK & Ireland.

B&Q's trade-focused banner, TradePoint, delivered a strong performance driven by demand in the DIFM and trade customer segment. LFL sales for TradePoint were up 7.1%, with penetration of B&Q sales up by two percentage points to 22% (H1 23/24: 20%). This was supported by strong performances in its surfaces & décor and building & joinery categories. Sales of 'big-ticket' categories to trade customers were resilient, particularly in bathroom & storage, outperforming the rest of B&Q. TradePoint's loyalty programme continues to resonate with tradespeople, with new sign ups increasing by 22% YoY, and the business remains focused on strengthening relationships with its customers through further investment in dedicated sales partners, now present in 44 stores and driving a clear uplift in sales. TradePoint is present in 208 stores within the B&Q network (67% of stores).

Screwfix total sales increased by 4.5% (LFL +1.2%) to £1,301m, reflecting robust demand from trade customers. In particular, the business achieved good LFL sales growth in its tools & hardware, building & joinery and outdoor categories. In Q2, Screwfix delivered a resilient performance against tougher prior year comparatives (LFL +0.1% vs Q2 23/24 +5.6%), driven by positive LFL sales of core categories. Screwfix's e-commerce sales increased by 4.5% YoY, with e-commerce sales penetration of 59% (H1 23/24: 58%; H1 19/20: 32%). This was supported by several app-exclusive campaigns in the period, and the extension of its Screwfix Sprint proposition to an additional 100 stores (i.e., one-hour home delivery now available in over 430 stores, covering c.53% of UK postcodes). Overall, the business gained significant market share in H1.

Space growth and acquisitions contributed c.3% to total Screwfix sales. Screwfix opened 16 new stores - 15 in the UK (including two 'Screwfix City' ultra-compact format stores) and one in Ireland - bringing its total to 938 as of 31 July. The business continues to plan for up to 40 new stores in the UK & Ireland in FY 24/25, and remains on track to reach its medium-term goal of over 1,000 stores. Screwfix Spares continues to perform in line with expectations, and contributed c.1.0% to total Screwfix sales growth.

Further progressing its international expansion plans, Screwfix opened five stores in France in H1, with 25 stores in total as of 31 July.

Source : Kingfisher plc

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.