UK DIY News

Like-For-Like Growth For B&Q And Screwfix

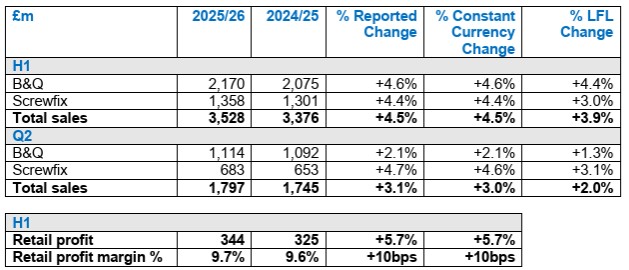

Kingfisher has published half year results for the six months ended 31 July 2025 (unaudited).

Kingfisher Poland and other international

UK & IRELAND

Market

- Low single digit market growth.

- The UK consumer has remained resilient with improving mortgage affordability, real wage growth, and stable housing transactions in H1. The home improvement market has also been supported by favourable weather conditions in Q1, driving strong demand for seasonal products.

- We remain mindful of early signs of softness in the labour market, uncertainty ahead of the Autumn Budget, and rising inflation.

B&Q

- Total sales +4.6% (LFL +4.4%) to £2,170m, with growth driven by our initiatives in trade, e-commerce and innovation in big ticket categories. This was further supported by customer transference from the closure of Homebase stores and seasonal products due to favourable weather.

- Core LFL growth was led by painting and tools & hardware categories.

- Big-ticket LFL growth was underpinned by our successful range reviews. The introduction of our tiered kitchen offering – Essential, Select, and Signature – has broadened customer appeal and contributed meaningfully to performance.

- Strong seasonal LFL growth was due to our outdoor categories, which also benefitted from recent Homebase store closures.

- Market share gains (as measured by BRC, Barclays, and GfK), driven by progress in our strategic initiatives of trade and e-commerce and benefit from Homebase stores closures in 2024.

- TradePoint, B&Q’s trade focused banner delivered +6.9% LFL growth and now represents 22.4% of B&Q total sales (H1 24/25: 22.0%). A clear focus on product, price, and customer engagement, supported by further investment in dedicated trade sales partners – now present in 77 stores (up from 44 as at 31 January 2025) helped drive H1 performance. TradePoint is now present in 222 B&Q stores, representing 70% of the total estate.

- We have improved brand visibility, with TradePoint now integrated into B&Q advertising campaigns during the half. TradePoint saw strong growth in e-commerce, particularly in click & collect, supported by high app engagement that continues to drive store footfall. Our TradePoint app supports the trade loyalty programme and helps customers track spend thresholds. Active app membership grew 9% YoY to 1.4 million, with app sales now accounting for 25% of TradePoint’s online sales.

- E-commerce sales rose +23.8% YoY, with penetration of 16.4% at H1 (H1 24/25: 14.1%). Strong growth in marketplace with GMV(1) up +45.4% to £228m leading to a retail profit contribution(2) of c.£7m, supported by progress in onboarding cross-border vendors with 69 onboarded as at 31 July.

- B&Q opened nine stores – including eight converted Homebase sites – and closed two. As of 31 July, it operated 317 stores across the UK and Ireland. Space growth contributed +0.2% to total B&Q sales.

Screwfix

- Total sales +4.4% (LFL +3.0%) to £1,358m, with strong growth across all categories reflecting the benefit of our strategic initiatives and healthy demand from trade customers.

- Market share gains (as measured by BRC, Barclays, and GfK), driven by progress in our strategic initiatives.

- E-commerce sales increased by 4.3% YoY and e-commerce sales penetration reached 59.2% (H1 24/25: 59.3%). H1 performance was supported by continued growth in the Screwfix app, with app sales up +9.2% YoY.

- The app now accounts for over 23% (H1 24/25: 22%) of total sales. Screwfix app remains the most convenient way to shop, offering personalised rewards, a visual search engine via “Lens”, streamlined collection via “Check-In”, and rapid delivery through “Screwfix Sprint” (now delivering in as little as 20 minutes).

- Space growth contributed c.1.4% to total Screwfix sales. Screwfix opened 9 new stores (including 4 ‘Screwfix City’ ultra-compact format stores) in the UK along with 3 closures bringing its total to 958 as of 31 July. We are targeting up to 35 new store openings in the UK & Ireland in FY 25/26 and remain on track to reach the medium-term goal of over 1,000 stores.

- The results for Screwfix France are captured in ‘Screwfix France and Other’

UK Retail Profit

- Gross margin increased 90 basis points supported by the margin-accretive impact of B&Q’s expanding marketplace, effective management of product costs and pricing and supplier negotiations. These drivers more than offset headwinds from new packaging taxes in the half and the adverse category sales mix within B&Q.

- Operating costs increased by 7.5% driven by higher staff costs (reflecting wage inflation and flexing to support increased volumes – alongside increased UK employer NI contributions), costs from 28 net new store openings since H1 24/25, and the annualisation of last year’s £24m one-off business rates refund at B&Q in H1. Cost increases were partially offset by savings achieved through our structural cost reduction programme.

- Retail profit increased 5.7% to £344m (H1 24/25: £325m, at reported rates). Retail profit margin % increased by 10 basis points to 9.7% (H1 24/25: 9.6%, at reported rates).

Source : Kingfisher plc

Image : Kingfisher plc

23 September 2025

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.

Paul Boyce - European CEO, QEP Ltd.