UK DIY News

Lords: ‘Strong Growth In Merchanting And Continued Strategic Progress’

Lords (AIM:LORD), a leading distributor of building materials in the UK, today announces its unaudited Interim Results for the six months ended 30 June 2025 (‘H1 2025’ or the ‘Period’).

H1 2025 Highlights

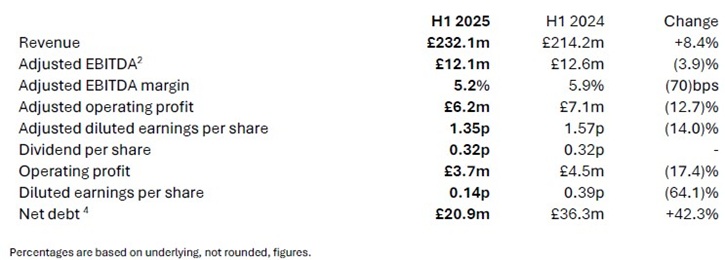

- Group revenue up 8.4% to £232.1m (H1 2024: £214.2m) and like-for-like1 revenue up 7.0%

o Merchanting division continues to grow with revenue up 12.6% to £117.7m (H1 2024: £104.6m) and divisional Adjusted EBITDA2 up 8.6% to £8.2m

o Plumbing and Heating ('P&H') grew revenue by 2.4% to £112.2m (H1 2024: £109.6m) and delivered divisional Adjusted EBITDA2 of £3.9m (H1 2024: £4.2m, before the benefit of £0.8m from CHMM3 which subsequently reversed in H2 2024) - Acquisition of the UK's largest online-only retailer of construction products, Construction Materials Online (‘CMO’), in June 2025 for a cash consideration of £1.8m

- Completed sale and leaseback of four trading sites in April 2025 for gross proceeds of £13.1m to provide additional liquidity to leverage growth opportunities as the market recovers

- Strategic progress continues with three new Merchanting branches opened in 2025 to date

- Group Adjusted EBITDA2 in line with pre-CHMM3 H1 2024 at £12.1m (H1 2024: £12.6m)

- Net debt reduced by £15.4m to £20.9m (30 June 2024: £36.3m) since June 2024

- Interim dividend maintained at 0.32 pence per share (H1 2024: 0.32 pence per share)

1 Like-for-like sales is a measure of growth in sales, adjusted for new, divested and acquired locations such that the periods over which the sales are being compared are consistent.

2 Adjusted EBITDA is EBITDA (defined as earnings before interest, tax, depreciation, amortisation and impairment charges) inclusive of property gains and losses but excluding exceptional items, and share-based payments.

3 CHMM is the Clean Heat Market Mechanism which was introduced in January 2024 and subsequently withdrawn which resulted in a benefit of £0.8m to Adjusted EBITDA in H1 2024 which reversed in H2 2024.

4 Net debt excluding leases.

5 Company compiled consensus expectations of Adjusted EBITDA for the year ended 31 December 2025 as at the date of this announcement show an average of £24.8m and a range between £24.7m and £25.1m.

Shanker Patel, Chief Executive Officer of Lords, commented:

“The Group has demonstrated strong revenue growth in the first half of 2025 as we continue to increase market share, despite a highly competitive RMI market in the South-East and the recent UK interest rate reductions not yet boosting consumer confidence.

“The strategic acquisition of the leading online-only retailer, CMO, the opening of three additional Merchanting branches and the strengthening of the Group’s balance sheet through £13.1m of property disposals during the period ensure that the Group is well-positioned for a future recovery in the market. Ahead of this, we will continue to focus on operational excellence, customer service, and working capital management. Additionally, we will carefully consider further opportunities to increase the Group’s market share both organically and through selective, value-added acquisitions.

“Whilst trading in the second half of 2025 to date has not seen any sustained improvement in the RMI market, and with the seasonally significant trading period ahead, performance continues in line with market expectations5 for full year Group Adjusted EBITDA.”

Chief Executive Officer’s Review

On behalf of the Board, I am pleased to report the Group’s unaudited Interim Results for the six months ended 30 June 2025.

Overview

The Group further increased its market share and delivered strong revenue growth of 8.4% in the first half of 2025, despite there being no substantive improvement in the Repairs, Maintenance and Improvement (‘RMI’) market, which represents approximately 80% of our activities. During the period, Lords has continued to drive long term growth through margin accretive organic initiatives, adding new products and new locations, and through selective and strategically significant acquisitions.

In January 2025, we increased our George Lines brand to five locations, with a new branch opening near Maidstone, Kent. In May 2025, we opened a combined Lords Builders Merchants and Advance Roofing branch following the opportunity to take over a site in Bicester and we expanded our Dry Lining and Insulation brand, AW Lumb, to three branches with a new two-and-a-half-acre site in Mansfield.

The Group has completed two strategic acquisitions in the last 12 months. Ultimate Renewables focusses on the design and delivery of renewable energy solutions in the plumbing and heating sector. On 6 June 2025, following a pre-pack administration, Lords acquired part of the formerly AIM listed business, CMO Group Limited (‘CMO’), the UK's largest online-only retailer of construction products. Lords acquired the construction materials and plumbing activities while CMO’s tiles business was simultaneously sold to a third party. The intellectual property and nine specialist websites acquired broadens our customers’ route to market by increasing our digital capabilities, and with CMO’s business model, provides the opportunity to leverage our stakeholder relationships and logistical infrastructure.

We also completed a sale and leaseback programme in the last 12 months realising c. £17m of proceeds which significantly enhanced the Group's balance sheet strength and also supports our strategy of scaling the business through organic growth and selective acquisitions.

Results

Revenue in the first half of 2025 increased by 8.4% to £232.1m (H1 2024: £214.2m). Like-for-like (‘LFL’) revenue, which adjusts for branches or businesses not part of the Group in the whole of the current or comparator period, was 7.0% ahead.

Gross profit increased but margins were slightly lower, partly due to product mix and partly due to the continuing challenging RMI market. Despite inflationary pressures in relation to employment costs, property and transport, overheads remained tightly controlled as we invested in new branches and businesses. Adjusted earnings before interest, tax, depreciation and amortisation (‘Adjusted EBITDA’) for the first half of 2025 was £12.1m (H1 2024: £12.6m). However, the first half of 2024 benefitted by c. £0.8m from the Clean Heat Market Mechanism (‘CHMM’) which reversed in the second half of 2024 due to delays in Government regulations. Adjusting for the positive effects of the CHMM in H1 2024, Adjusted EBITDA was £0.3m ahead of H1 2024.

Merchanting

Merchanting has performed well since the fourth quarter of 2024, delivering double digit LFL revenue growth. Our businesses more closely aligned to new build, such as Civils and Dry Lining, have performed particularly well. In the first half of 2025, revenue increased by 12.6% to £117.7m (H1 2024: £104.6m).

LFL revenue in the first half of 2025 increased by 11.5% with strong performance from AW Lumb, Advance Roofing and Hevey, Northampton. New branches added £2.4m of revenue to H1 2025.

Gross profit increased by 5.7% to £30.4m (H1 2024: £28.7m) and despite increased overheads due to new branch openings and additional costs of employment, Adjusted EBITDA increased by 8.6% to £8.2m (2024: £7.6m).

As reported previously, Steve Durdant-Hollamby joined as Chief Operating Officer of Merchanting in November 2024 to strengthen the management team and his experience in major building material companies spanning across merchanting and manufacturing has already begun to benefit the division.

Plumbing and Heating

Plumbing and Heating (‘P&H’) revenue increased by 2.4% to £112.2m (H1 2024: £109.6m) with LFL revenue 2.8% ahead. As previously reported, ahead of boiler price increases on 1 April 2024, our wholesale business, APP, experienced strong volumes in the first quarter, particularly in March, which was followed by destocking in the second quarter. Overall, APP increased boiler volumes by 6.8% in H1 2025 and maintained market share at c. 11%.

As reported last year, the introduction in January 2024 of CHMM and subsequent withdrawal a few months later, given the timing of claims and adjustments, the H1 2024 result benefitted by c. £0.8m which reversed in the second half. Adjusted EBITDA in H1 2024 would have been £4.2m excluding CHMM, which is £0.3m higher than H1 2025 at £3.9m (H1 2024: £5.0m).

Mr Central Heating, our digitally led P&H trade counter business, experienced a more challenging six months with revenue 13% lower than H1 2024. We have sought to address this by strengthening the management of this brand in the second half. Our spares and trade counters business, DH&P, performed well and increased LFL sales by 4.6% in the period. Ultimate Renewables has performed in line with expectations since joining the Group in October 2024 and revenue in renewables was 57% ahead of H1 2024.

On 2 September 2025, Matthew Webber joined the Group as Chief Operating Officer for our P&H division. Matthew brings a wealth of experience with over 20 years in the Heating, Ventilation, and Air Conditioning systems (‘HVAC’) sector. His background spans both supplier/manufacturer roles and merchant businesses, with a strong emphasis on the plumbing and heating industry. His leadership experience and industry insight will be instrumental in shaping the next phase of growth for our P&H division.

Neil Lake will transition into the role of Group Business Development Director, where he will work with our Group Operating Board in driving continued growth and innovation across Lords. Neil has played a key role in leading our P&H division since joining the Group through the acquisition of DH&P and will continue to maintain significant influence within the P&H division, supporting Matthew in his new role.

Digital

On 6 June 2025, Lords acquired the trade, assets and intellectual property of CMO for a consideration of £1.8m, inclusive of a property valued at £1.2m. The acquisition was part of a pre-pack administration process where the construction materials and plumbing and heating businesses were acquired by Lords and CMO’s tiles business was sold to a third party.

Originally formed in 2008, CMO was a disruptor to the traditional building materials market, with the majority of its sales being dispatched directly from the supplier, reducing the stock availability requirement from traditional local merchants. CMO’s experience in web-based sales and their intellectual property, combined with Lords distribution network broadens our customer base and channels to market. We welcome our new CMO colleagues to the Group and look forward to continue working closely together in the coming months.

Prior to its acquisition, CMO was operating in a highly leveraged environment which caused credit insurers to reduce their exposure leading to greater challenges to deliver customers’ orders and higher levels of refunds where web orders could not be delivered. The CMO team have worked diligently since joining the Group on product availability and lead times from suppliers to increase revenue and reduce refunds.

In the three weeks post-acquisition, CMO made a small loss but is expected to contribute positively in the second half as it aims to recover weekly revenue to levels achieved prior to supply chain challenges, it begins to leverage off Lords’ product range and procurement capability and establishes an efficient cost model for medium term growth.

Strategic developments

In the last 12 months, we have continued to drive accretive organic growth, through new branch openings and new product lines, particularly in Plumbing and Heating. We have completed two small but highly strategic acquisitions and significantly improved our balance sheet, converting c. £17.0m of property into cash.

We continue to believe that there is a significant consolidation opportunity to combine independent merchants and distributors within the fragmented UK building supplies sector where Lords has less than 1% market share. With CMO joining the Group, we now have over 1,000 colleagues, who deliver excellent customer service and have worked hard to deliver operational efficiencies to offset the operating cost pressures that all UK businesses have faced in 2025.

Outlook

The Group has demonstrated strong revenue growth in the first half of 2025 as we continue to increase market share, despite a highly competitive RMI market in the South-East and the recent UK interest rate reductions not yet boosting consumer confidence.

The strategic acquisition of the leading online-only retailer, CMO, the opening of three additional Merchanting branches and the strengthening of the Group’s balance sheet through £13.1m of property disposals during the period ensure that the Group is well-positioned for a future recovery in the market. Ahead of this, we will continue to focus on operational excellence, customer service, and working capital management. Additionally, we will carefully consider further opportunities to increase the Group’s market share both organically and through selective, value-added acquisitions.

Whilst trading in the second half of 2025 to date has not seen any sustained improvement in the RMI market, and with the seasonally significant trading period ahead, performance continues in line with market expectations for full year Group Adjusted EBITDA.

Financial Review

The Group has made significant progress with the support of its stakeholders over the last 12 months to continue to drive growth, tightly manage costs and working capital, complete two strategically important acquisitions and significantly reduce its net debt with the sale and leaseback of five operating properties.

Financial performance

In the first half of 2025, the Group delivered an 8.4% increase in revenue to £232.1million (H1 2024: £214.2m). Gross profit increased by 3.6% to £44.8m (H1 2024: £43.2m) and gross margin was 90 basis points lower at 19.3% (H1 2024: 20.2%), mainly due to product mix as volumes of lower margin products increased. Operating expenses increased by £2.0m to £34.4m (H1 2024: £32.4m) but £1.2m of the increase relates to businesses acquired and new branches, leaving a £0.8m like-for-like change.

In line with our FY 2024 results, we have re-presented our income statement in H1 2024 to align our disclosure with listed peers in the sector and separately show property gains of £1.7m (H1 2024: £1.7m) on the face of the income statement. In H1 2025, the property gain relates to the sale and leaseback of four operating properties for gross proceeds of £13.1m and in H1 2024, the Group received a lease surrender premium in relation to Merchanting’s Park Royal site.

Adjusted EBITDA was £12.1m (H1 2024: £12.6m). In the first half of 2024, our Plumbing and Heating division received c. £0.8m of benefit from the introduction and subsequent reversal of the CHMM, which reversed in the second half of 2024. Adjusted EBITDA in H1 2025 was marginally ahead of pre-CHMM H1 2024.

Source : Lords Group Trading PLC

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.