UK DIY News

Online Sales Expected To Add £5.3bn To UK Ecommerce Sector This Year

The surge in online shopping caused by the COVID-19 pandemic is expected to add £5.3bn to UK ecommerce sales this year to make a total of £78.9bn. This is according to analysts at Edge Retail Insight, the global trend forecasting arm of retail insights firm Edge by Ascential, who have updated all pre-existing forecasts to account for the significant long-term impact of COVID-19 on consumer shopping behaviours and preferences.

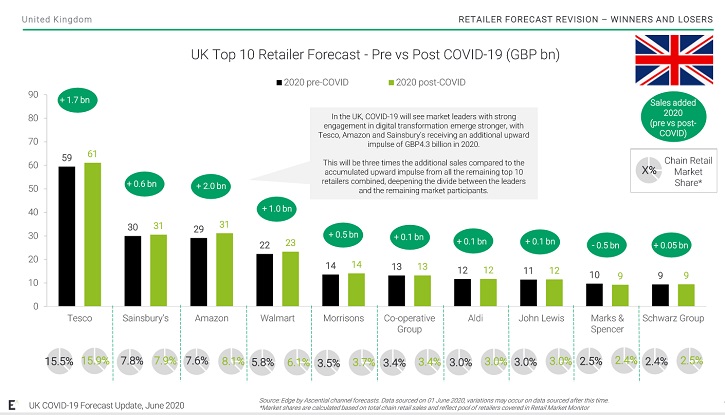

Amazon is expected to benefit the most from this surge in demand for online retail, adding an extra £2bn in UK sales, totalling £31.1bn by the end of 2020, up from analysts’ initial £29.1bn prediction prior to the pandemic.

Tesco is expected to generate the most revenue in 2020, with forecasted gross sales rising by an extra £1.7bn to reach a total of £61.1bn, up from forecasts of £59.4bn prior to the pandemic. This is followed by Sainsbury’s, which will add an extra £0.6bn in sales to reach £31bn (from £30bn) by the end of 2020.

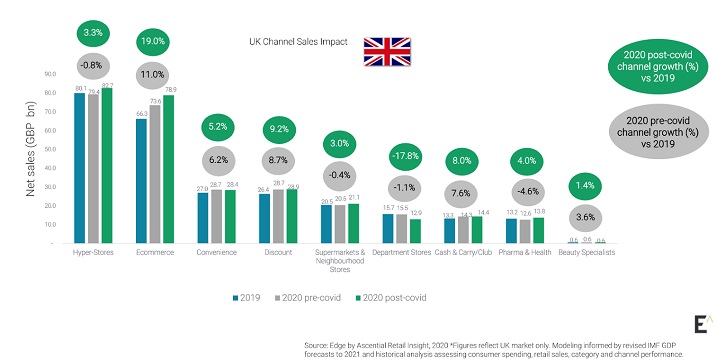

Analysts at Edge Retail Insight have also upgraded the UK outlook for the following retail channels:

- Ecommerce: Online sales are now expected to grow from initial predictions of 11% to 19% in 2020, reaching £78.9bn, this is up from £66.3bn in 2019.

- Grocery hyper-stores: A revised growth of 3.3%, up from -0.8%, as a result of increased home cooking, following the cautious reopening of eateries and restaurants. This will now account for £82.7bn in sales.

- Pharmacies and health retailers: Health stores will see a significant boost, up from initial predictions of -4.6% to a growth of 4.0% in 2020. This will account for £13.8bn in sales, as conscious consumers continue to look after their health post-pandemic.

- Discounters (9.2% up from 8.7%) and neighbourhood stores and supermarkets (3.0% up from -0.4%) will experience modest growth at £28.9bn and £21.1bn respectively. Cash and carry operators (up 8.0% from 7.6%) will see a small increase.

Moreover, predictions for the following retail channels have been revised down by analysts as a result of COVID-19 disruption:

- Department stores: Following months of store closures, growth will further decline from initial predictions of -1.1% to -17.8%, to an estimated £12.9bn in 2020, as shoppers are expected to continue to shop online despite stores reopening.

- Convenience stores: Growth is revised down to 5.2% from 6.2% prior to COVID-19, but is still expected to reach a modest £28.4bn in 2020, from £28.7bn in 2019.

- Beauty specialists (down to 1.4% from 3.6%) will experience a significant decline in sales post-COVID-19, as beauty businesses remain some of the last retailers to reopen

As well as revising its 2020 retail outlook, Edge Retail Insight has further assessed the impact of COVID-19 on day-to-day retail activity via its Retail Market Monitor platform. This includes tracking the assortment and availability of high in demand products at major UK grocery retailers, as well as closely monitoring the promotional levels at these retailers, with the most recent analysis revealing that UK supermarkets increased weekly promotional levels by as much as 76% in the week ending 17th May.

Duncan Painter, CEO of Ascential, said, “COVID-19 has greatly accelerated the general shift to digital commerce and it is vital that business leaders have market leading insights at their fingertips to inform decision-making at this crucial time. It is only through identifying what consumers want and harnessing the entire ecosystem to address these needs that brands can achieve relevance, impact and importantly, growth. As a crucial partner to retail clients during these trying times, our expert analysts at Edge by Ascential Retail Insight, one of the four pillars of the Edge by Ascential product suite, have their finger on the pulse and have rapidly updated all forecasts to account for the economic disruption we are witnessing, giving decision-makers the information they need to get on the road to recovery.”

Xian Wang, Senior Director of Product and Content at Edge by Ascential, said: “The COVID-19 pandemic has almost certainly had a lasting impact on the retail sector, reshaping consumer shopping habits, and the priorities for retailers and brands. Most prominently, we’re seeing a significant shift to online, as consumers have become reliant on this, following the swathe of store closures globally. This will no doubt lead strong ecommerce players, such as Amazon, to benefit from this greatly.”

Wang continues: “We are one of the first retail insights firms to review and update all of our forecasts for 2020, which are crucial in helping businesses recalibrate in the post-COVID-19 retail landscape. Our new features and revised research reports and insights will be essential in helping to guide businesses carefully as they seek to revise route-to-market execution strategies in this new environment. ”

Interested in learning more about how COVID-19 is impacting retail? Check out Edge by Ascential’s Retail Insight Reforecasting for COVID-19 resource page.

Source : Edge by Ascential

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.