UK DIY News

Sainsbury's Raises Guidance In Q3 Update

Sainsbury's has published Interim Results for the 28 weeks ended 13 September 2025, noting a 'Winning combination of value, quality and service driving continued market share gains'

Simon Roberts, Chief Executive of J Sainsbury plc, said: “We started this year with one clear priority - to sustain the strong competitive position we have built over the last five years. We have delivered on this in the first half, with focused and effective investment to ease cost-of-living pressures, keeping price inflation behind the wider market and delivering our winning combination of great value, trusted quality and leading service. This has driven continued grocery volume growth ahead of the market for a fifth consecutive year and a profit performance ahead of our expectations.

"We planned for a strong Summer and we really delivered, with leading product innovation and outstanding fresh food availability when demand was highest throughout the hot weather. At Argos we delivered a good seasonal performance, grew market share and improved profitability. A huge thank you to all our hard working and dedicated colleagues, suppliers and farmers who make this possible every day.

“We’re investing where it matters most with Aldi Price Match on everyday essentials and bringing personalised Your Nectar Prices to all supermarket customers. Customers saved an average of £14 on an £80+ big weekly shop with Nectar Prices. Value perception is improving across supermarkets, convenience stores and online. We’ve continued to invest in innovation too, including launching our new Taste the Difference Discovery ranges for restaurant quality food at home. In its 25th year, more and more customers are shopping Taste the Difference, driving the biggest premium own-label share gains in the market.

“Our offer has never been stronger. So while we expect the market to remain highly competitive, our momentum gives us real confidence as we head into Christmas and we have strengthened our profit guidance today."

Financial Highlights

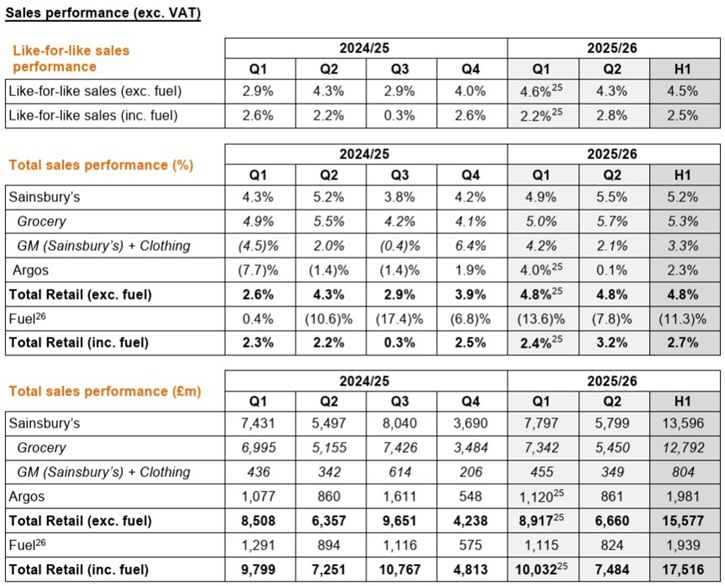

- Sainsbury’s sales (excluding fuel) up 5.2%, with Grocery sales growth of 5.3% and Sainsbury’s General Merchandise & Clothing sales up 3.3%. Argos sales up 2.3%, Fuel sales down 11.3%

- Retail underlying operating profit £504m, ahead of our expectations and in line with last year, with strong trading and cost savings delivery enabling focused investments in value, customer service and quality and offsetting higher employment and regulatory costs and disruption from space reallocation activity

- Statutory profit after tax £165m (HY 2024/25: £76m). Non-underlying items of £(72)m on a post-tax basis predominantly relate to Retail restructuring costs and the phased withdrawal from Financial Services

- Retail free cash flow £310m. On track to exceed £500m for the full year • Bank disposal proceeds will now exceed £400m, higher than originally expected. £400m will be returned to shareholders via a £250m special dividend and £150m incremental share buyback. Of the £150m, £50m will be added to the previously announced £200m buyback in financial year 2025/26 and the remaining £100m will be added to the core buyback in financial year 2026/27

- Interim dividend of 4.1 pence per share, up 5%

- Total cash returns to shareholders in financial year 2025/26 now expected to exceed £800m

2025/26 Outlook

Our focused and effective investment in value, quality and service in the first half further strengthened our customer proposition relative to competitors and helped deliver a sales and profit performance ahead of our expectations. This means that, while we will continue to make balanced choices to invest and sustain the strength of our competitive position through the most important trading period of the year, we now expect Retail underlying operating profit of more than £1 billion. We continue to expect to deliver Retail free cash flow of more than £500 million.

Enhanced cash returns:

Special dividend, Ordinary dividend and Share buyback We now expect net cash proceeds from the disposal of our banking operations to exceed £400 million, reflecting very good progress with our phased withdrawal from core Banking products. As previously announced, we will return £250 million of these proceeds to shareholders via a special dividend of 11.0 pence per share. This will be paid on 19 December 2025 to shareholders on the Register of Members at the close of business on 14 November 2025.

We are no longer proposing a share consolidation alongside payment of the special dividend. We will additionally return £150 million of bank disposal proceeds through share buybacks, with £50 million to be added to the core £200 million buyback in financial year 2025/26 and £100 million to be added to the core buyback in financial year 2026/27.

We announced in April 2025 that we would buy back £200 million of shares in the financial year 2025/26. We bought back c.57 million shares with an aggregate purchase price of £158 million in the period between 22 April 2025 and 12 September 2025. We will complete the remaining £42 million of this programme by the end of the 2025/26 financial year as well as the additional £50 million announced today.

The Board has recommended an increased interim dividend of 4.1 pence per share (HY 2024/25: 3.9 pence). Consistent with prior years, this represents 30 per cent of the prior year’s full year dividend per share. This will be paid on 19 December 2025 to shareholders on the Register of Members at the close of business on 14 November 2025.

Balanced choices delivering strong momentum

Halfway through the three-year plan that we set out in February 2024, we are making good progress against our commitments, further strengthening our customer proposition relative to competitors whilst navigating high levels of operating cost inflation. This is delivering continued strong momentum as more and more customers are trusting us to consistently deliver great value alongside the outstanding quality and service they have always expected from Sainsbury’s.

We continue to strengthen our capabilities, having made key appointments across retail, clothing, technology and data as well as accelerating the Argos transformation through dedicated leadership. We have invested further in hourly colleague pay and made two pay increases in March and August of this year while investments in technology and automation are driving sustained benefits in stores and logistics. We have a healthy pipeline of new initiatives to deliver future efficiency improvements.

We have invested in growing our food footprint in existing supermarkets and through new store openings in key target locations to ensure that more customers are able to access the best of our ranges, building on our competitive advantages in product range and quality.

We continue to grow long-term strategic relationships with key food suppliers, ensuring resilience and quality of supply and support for ongoing product innovation and sustainability improvements. We are capitalising further on the strong foundations we have built across Nectar, extending access to personalised Your Nectar Prices to more customers and launching Nectar360 Pollen, our world class retail media platform that will deliver outstanding results for clients and strong revenue growth for Nectar360.

Our investment in the business is supported by the strength of our balance sheet and consistent cash generation. This additionally allows us to deliver healthy returns to shareholders. We anticipate returning more than £800 million to shareholders this financial year through dividends and share buybacks.

Across the business, we remain confident on delivering on the eight commitments that we made in February 2024 over the life of the Next Level Sainsbury’s plan:

• Food volume growth ahead of the market

• Customer satisfaction higher 26/27 vs 23/24

• Colleague engagement higher 26/27 vs 23/24

• Deliver our Plan for Better commitments • Deliver profit leverage from sales growth

• £1bn of cost savings over three years to 26/27

• £1.6bn+ Retail free cash flow over three years to 26/27

• Higher return on capital employed

Our progress against these commitments will be driven by our four strategic outcomes: First choice for food, Loyalty everyone loves, More Argos, more often and Save and invest to win.

More Argos, more often

We are making good progress with the Argos transformation plan, with higher sales, market share growth and improved profitability, particularly against a second quarter last year where strategic clearance activity increased sales but diluted trading margins. Sales grew by 2.3 per cent, supported by warm and dry Summer weather in an otherwise subdued, competitive and deflationary market. We continue to strengthen our online offer, improving the digital customer journey and driving higher online traffic and basket size. We have a strong trading plan in place as we head into the important Black Friday and Christmas trading period.

Strategic progress

- We are delivering more inspiring choices for customers through extending our ranges and forming deeper brand partnerships with key suppliers. We continue to grow our Supplier Direct Fulfilled offer, introducing more than 6,000 new products so far this year, including new premium brands such as Oura, and have recently enabled customers to choose to collect in store

- Customers continue to trust Argos to deliver great value, with our Big Red events supporting improved value perception24. Alongside this, we have increased the visibility of value-added services, including pre-order and trade-in, and we have launched a new partnership with Airtasker. We are also trialling Argos Plus, a 12-month subscription for free delivery on all orders greater than £20

- With around 80 per cent of all Argos sales now through digital channels, we are increasingly focused on personalisation within the Argos digital experience, providing customers with relevant recommendations based on their browsing behaviour and inspiration to support bigger basket shopping. Alongside this, we have upgraded the Argos App, including enhancing product pages and improving findability, enabling app exclusive offers and making it easier and faster for app customers to collect their products. More customers are using the app as a result, with positive customer feedback and strong revenue growth as we grow loyalty and encourage greater shopping frequency

- We are growing brand awareness and consideration of Argos as a destination for desirable, premium products, driving greater engagement through social channels and launching our own podcast

- Having focused in recent years on relocating the Argos estate from standalone stores to stores and collection points inside Sainsbury’s, we are now focusing on optimising our 1,100 points of presence to provide the best customer journey at the same time as reducing cost to serve. We are improving the speed and ease of collection for customers, giving more self-service options and implementing an improved service model through modernising in-store technology

- We are additionally optimising our market-leading delivery to bring greater efficiency and modernising our supply chain through a new local fulfilment centre warehouse system

Source : J Sainsbury PLC

Image : J Sainsbury PLC

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.