UK DIY News

SIG Posts 1% Rise In LFL Sales; New CEO Announced

SIG plc ("SIG", or "the Group"), a leading supplier of specialist insulation and building products across Europe, today issues a trading update for the six months to 30 June 2025 ("H1" or "the period"), in advance of the release of its H1 results on 5 August 2025.

Key points

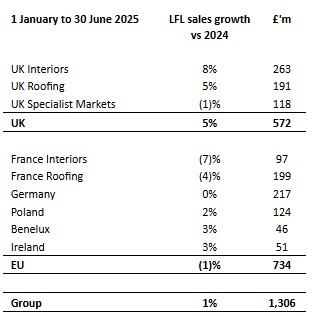

- Group revenue of £1,306m, representing 1% like-for-like1 ("LFL") revenue growth versus prior year, reflecting continued market outperformance

- Underlying operating profit2 for H1 expected to be c£15m (H1 2024: £12m), with ongoing impact of productivity initiatives partially offsetting continued softness in market demand

- Group continues to execute on its strategic initiatives to drive cost savings and productivity, and to improve cash generation

- Robust cash performance in the period, with initiatives offsetting much of the normal seasonal increase in working capital

- Group's 2025 full year outlook unchanged

The Group has also issued an update on CEO succession this morning, and will welcome Pim Vervaat as CEO and Chair designate on 1 October 2025. Further details are set out in that announcement.

Summary

Group LFL sales were up 1% year-on-year in the period, with LFL volumes up 2%. Continued pricing pressure in the market more than offset modest inflation on input costs, leading to a net 1% reduction in pricing. Reported revenues of £1,306m were 1% down on prior year, reflecting an impact of 1% in aggregate from working days and exchange rates, as well as a 1% net impact from branch closures and openings.

Demand in all markets remains well below historical levels, and trends in the second quarter were similar to those experienced in Q1, with European construction at a low point in the cycle.

Ongoing commercial and operational initiatives are enabling the business to outperform these local markets. In particular, the UK Interiors business has delivered significantly improved top and bottom-line performance as a result of actions taken by the management team over the last nine months, and the UK Roofing business continues to perform strongly. The German and French businesses are continuing to perform robustly relative to particularly challenging markets. The Benelux business has delivered improved results as the management team execute their turnaround plan.

Other actions to manage near-term margin pressure and to strengthen our operating platform and margin for the long term are ongoing, alongside targeted investment to support our strategic growth opportunities. The benefits from productivity and cost initiatives will continue to contribute incrementally as the year progresses.

The Board expects to report net debt at 30 June of £525m, including leases, (31 December 2024: £497m) and liquidity of £171m (31 December 2024: £177m). The latter consists of £81m of gross cash balances and a £90m RCF facility that has remained undrawn. The cash balance reflects a free cash outflow of around £10m in the period, with meaningful progress on working capital initiatives offsetting much of the normal seasonal increase in working capital. Sustained medium and long-term improvement in cash flow generation remains the Group's primary financial objective.

Outlook

The Board continues to expect the Group to deliver full year underlying operating profit in line with market expectations.3 Having seen no notable pick-up in demand during the period, the Board remains cautious as to the prospect of meaningful market improvement during the second half.

As noted previously, the operational gearing in our business model applies equally strongly in conditions of rising demand, and, accordingly, the Board believes the Group remains very well positioned to benefit from the market recovery when it occurs.

H1 Results date

We will publish our H1 2025 results on 5 August 2025 and hold a conference call for analysts and investors on that date.

1. Like-for-like is defined as sales per working day in constant currency, excluding completed acquisitions and disposals, and adjusted to exclude the net impact of branch closures and openings.

2. Underlying represents the results before Other items. Other items relate to the amortisation of acquired intangibles, impairment charges, profits and losses on agreed sale or closure of non-core businesses and associated impairment charges, net operating profits and losses attributable to businesses identified as non-core, net restructuring costs, and other non-underlying profits or losses.

3. Company collated analyst expectations is for Full Year 2025 underlying operating profit (EBIT) of £31.6m, within a range of £30m to £35m, as at 7 July 2025.

Appointment of CEO and Chair designate

The Board of SIG is pleased to announce the appointment of Pim Vervaat as the Company's new Chief Executive Officer and Chair designate.

Pim will take up the role of CEO and join the Board on 1 October 2025. This appointment follows the announcement on 9 May 2025 that the Company had received notice from Gavin Slark of his resignation as CEO.

As part of SIG's longer term succession planning, it is expected that Pim will transition to the role of Non-Executive Chair approximately 18 months later, when Andrew Allner intends to step down as Non-Executive Chair, and from the Board. At this time Andrew will have served a full term in his role, having been appointed in November 2017. A process to identify Pim's successor as SIG's CEO will be undertaken in advance of this handover.

Pim, a Dutch national, has served as the CEO of large scale European industrial companies in both the UK listed sector and under private equity ownership. He most recently served as CEO of Constantia Flexibles, a €2 billion turnover flexible packaging company, which was acquired by One Rock in 2024. Prior to that he was CEO of the UK listed plastic products business, RPC Group, from 2013 to 2019, where he also served as CFO from 2007 to 2013. Pim is also currently Senior Independent Director of Luceco plc, a UK listed company offering wiring accessories, LED lighting, portable power and other products.

Commenting on Pim's appointment, SIG's Non-Executive Chair Andrew Allner said: "The Board is delighted to announce that Pim has agreed to join SIG as its CEO and Non-Executive Chair designate. He has significant experience of operating in decentralised European businesses and a strong track record of delivering shareholder value. The Board looks forward to working with Pim on SIG's growth and development."

Save as set out below, there are no other disclosures required in respect of the appointment of Pim Vervaat pursuant to UKLR 6.4.8 (1) to (6).

In light of the proposed CEO appointment, SIG has exercised its right to place its existing CEO Gavin Slark on garden leave for the remainder of his employment, until 31 December 2025. As a result, Gavin has stepped down as a director of the Company with effect from today's date. The Company continues to have strong and experienced leaders in each of its businesses, operating under SIG's well established devolved structure. In the period to 1 October 2025 the Group's CFO, Ian Ashton, will continue to work closely with them and will be responsible for the day-to-day operations of the Group. The whole executive team, together with the Board, remain focused on continuing the successful execution of the initiatives in place to improve SIG's businesses and drive the Group's operating and financial performance.

Source : SIG plc

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.