International DIY News

The Home Depot: Q3 Sales Miss Expectations

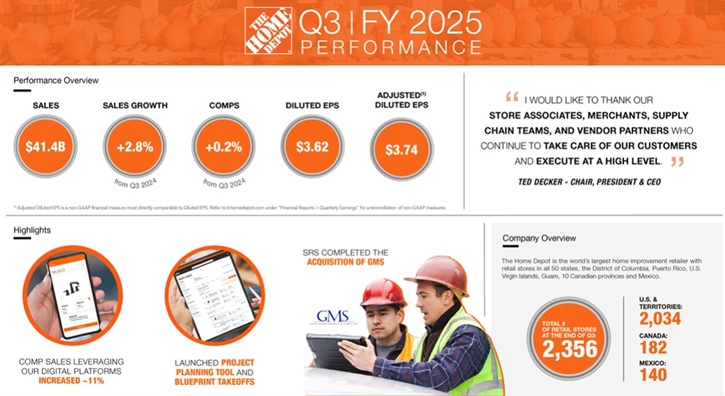

The Home Depot®, the world's largest home improvement retailer, today reported sales of $41.4 billion for the third quarter of fiscal 2025, an increase of $1.1 billion, or 2.8% from the third quarter of fiscal 2024. Total sales include approximately $900 million from the recent acquisition of GMS Inc. (GMS), which represents approximately eight weeks of sales in the quarter. Comparable sales for the third quarter of fiscal 2025 increased 0.2%, and comparable sales in the U.S. increased 0.1%.

Net earnings for the third quarter of fiscal 2025 were $3.6 billion, or $3.62 per diluted share, compared with net earnings of $3.6 billion, or $3.67 per diluted share, in the same period of fiscal 2024.

Adjusted(1) diluted earnings per share for the third quarter of fiscal 2025 were $3.74, compared with adjusted diluted earnings per share of $3.78 in the same period of fiscal 2024.

"Our results missed our expectations primarily due to the lack of storms in the third quarter, which resulted in greater than expected pressure in certain categories. Additionally, while underlying demand in the business remained relatively stable sequentially, an expected increase in demand in the third quarter did not materialize. We believe that consumer uncertainty and continued pressure in housing are disproportionately impacting home improvement demand," said Ted Decker, chair, president and CEO. "Our teams are continuing to execute at a high level and we believe we are growing our market share. I would like to thank our associates for their continued hard work and dedication."

Fiscal 2025 Guidance

The company updated its fiscal 2025 guidance, a 52-week year compared to fiscal 2024, a 53-week year, to reflect its third quarter performance, continued pressure in the fourth quarter from the lack of storm activity, ongoing consumer uncertainty and housing pressure, and the inclusion of GMS.

- Total sales growth of approximately 3.0%

- GMS expected to contribute approximately $2.0 billion in incremental sales

- GMS expected to contribute approximately $2.0 billion in incremental sales

- Comparable sales growth to be slightly positive for the comparable 52-week period

- Approximately 12 new stores

- Gross margin of approximately 33.2%

- Operating margin of approximately 12.6%

- Adjusted(1) operating margin of approximately 13.0%

- Tax rate of approximately 24.5%

- Net interest expense of approximately $2.3 billion

- Diluted earnings-per-share to decline approximately 6.0% from $14.91 in fiscal 2024

- Adjusted(1) diluted earnings-per-share to decline approximately 5.0% from $15.24 in fiscal 2024

- Capital expenditures of approximately 2.5% of total sales

At the end of the third quarter, the company operated a total of 2,356 retail stores and over 1,200 SRS locations across all 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, 10 Canadian provinces and Mexico. The Company employs over 470,000 associates. The Home Depot's stock is traded on the New York Stock Exchange (NYSE: HD) and is included in the Dow Jones industrial average and Standard & Poor's 500 index.

(1) The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). As used in this earnings release, adjusted operating income, adjusted operating margin, and adjusted diluted earnings per share are non-GAAP financial measures. Refer to the end of this release for an explanation of these non-GAAP financial measures and reconciliations to the most directly comparable GAAP measures.

Source : The Home Depot

Image : Rob Wilson / shutterstock / 180692453

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.