UK DIY News

Travis Perkins: H1 Group Revenue Decline; Toolstation Gains Market Share

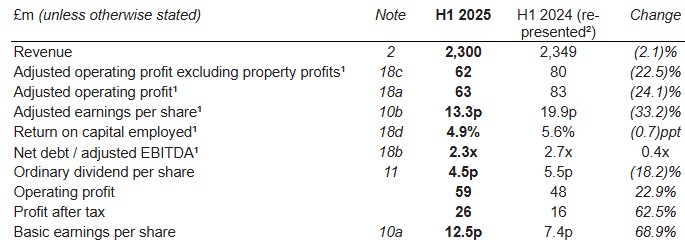

Travis Perkins plc, the UK's largest distributor of building materials, announces its half year results for the 6 months to 30 June 2025

Focus on stabilising business performance

- Group revenue declined by (2.1)% driven primarily by operational challenges in the early part of the year

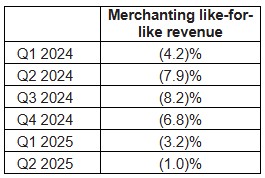

- Actions to drive volume in Merchanting taking effect, with Merchanting like-for-like sales (1.0)% in Q2 (versus (3.2)% in Q1) and market share decline arrested

- Proactive management of overheads to mitigate cost inflation and increased employer national insurance contributions

- Further progress in Toolstation UK with operating profit increasing 50% to £21m

- Overall, lower volumes in Merchanting resulted in adjusted operating profit of £63m (2024: £83m)

- Statutory operating profit of £59m (2024: £48m)

- The Group expects to deliver a full year adjusted operating profit (including £8m of property profits) broadly in line with current market expectations*

- New leadership structures implemented and highly experienced CEO, Gavin Slark, to join the Group on 1 Jan 2026

Continued strong progress on cash generation

- Net debt before leases reduced by a further £88m to £103m driven by substantial working capital inflow and proceeds from sale of Staircraft

- Net debt / adjusted EBITDA reduced by 0.4x to 2.3x through working capital improvements, discipline on capital investment and exit of Toolstation France

(1) Alternative performance measures are used to describe the Group's performance. Details of calculations can be found in the notes listed.

(2) For continuing businesses only. The Toolstation France business is treated as a discontinued operation.

* Company compiled consensus published as at 29 July 2025 showed FY25 adjusted operating profit (including property profits) with a range of £135m to £148m and a mean of £141m. See link: https://www.travisperkinsplc.co.uk/investors/analyst-consensus/

Chair Geoff Drabble, commented:

"The first quarter was difficult with a continued trend of market share loss and revenue decline in Merchanting. However, I was encouraged by the response of the business to management actions to drive a more customer-focused approach. In the second quarter we delivered improved revenue performance and stabilised Merchanting market share and these trends have continued into July.

We will build on this momentum in the second half as we deploy further system enhancements that put the difficult Oracle implementation behind us. The strong performance of Toolstation UK, which operates in similar markets to the Group's other businesses, demonstrates our potential without internal distractions.

Whilst the market outlook for the second half remains uncertain, the Board anticipates that the Group will deliver a full year result broadly in line with current market expectations*."

Analyst Presentation

Management are hosting a results presentation at 8.30am. For details of the event please contact the Travis Perkins Investor Relations team as below. The presentation will also be available via a listen-only webcast - please register at the following link:

https://travis-perkins-2025-half-year-results-presentation.open-exchange.net/

H1 2025 Performance

The Group delivered revenue of £2,300m, down (2.1)% versus prior year. The decline in revenue was driven by the Merchanting segment with activity across the majority of end markets remaining subdued. Toolstation delivered a robust revenue performance with further market share gains as maturity benefits continue to come through.

Adjusted operating profit of £63m was £(20)m, or (24)%, lower than the first half of 2024. The following key factors impacted on operating profit during the first half of the year:

- £(18)m decline in gross profit which was primarily driven by lower trading volumes, greater promotional activity and one less trading day in the Merchanting businesses.

- Overheads were in line with prior year as cost inflation and increased employer national insurance contributions were mitigated by proactive cost management

- Property profits were £(2)m lower than prior year.

Leadership and structures

Following the departure of Pete Redfern in March 2025, the Group has appointed Gavin Slark as CEO with Gavin due to join the business on 1 Jan 2026. Gavin is a highly experienced public company CEO with significant experience of the building materials and merchanting industry having been CEO of SIG plc since 2023. Prior to this he was CEO of Grafton Group plc (2011-22) and CEO of The BSS Group plc (2006-11) before its acquisition by Travis Perkins plc.

The Group has implemented a new operating structure for the Specialist Merchant businesses - BSS, CCF, Keyline and TF Solutions - which now all report into a Specialist Merchant Managing Director, sitting on the Group Leadership Team, with Catherine Gibson appointed to the role. Managing Directors have also now been appointed in all of the Specialist businesses.

In Toolstation UK, Lakhvir Sanghera has been appointed as Managing Director, following the upcoming retirement of Angela Rushforth, while Richard Lavin has taken up the role as Managing Director of Travis Perkins General Merchant. Catherine, Lakhvir and Richard have extensive industry experience, having all been with the Group for over a decade.

Balance sheet

The Group has made further strong progress on strengthening the balance sheet during the first half, with overall net debt reducing by £135m and net debt before leases reducing by £88m. Accordingly, despite the further reduction in adjusted operating profit, leverage (net debt / adjusted EBITDA) has reduced to 2.3x. Over the past 18 months management actions have unlocked over £250m of capital to fund restructuring activity and reduce net debt by £212m. The Group remains focused on returning leverage to its target range of 1.5 - 2.0x as soon as is practically possible.

Dividend

The Board is recommending an interim dividend of 4.5 pence per share (2024: interim dividend of 5.5 pence per share), in line with the Group's policy to pay a dividend of 30-40% of adjusted earnings. The dividend will be paid on 7 November 2025 to shareholders on the register as at close of business on 3 October 2025.

Outlook

Whilst the Group continues to make progress on actions to stabilise performance, end market demand remains subdued and the timing of a recovery in the UK construction sector is uncertain. Given this demand backdrop, the Group expects to deliver a full year adjusted operating profit (including £8m of property profits) broadly in line with current market expectations*

Technical guidance

The Group's technical guidance for 2025 is as follows:

- Expected ETR of around 30% on UK generated profits

- Base capital expenditure of around £80m

- Property profits of £8m

Adjusting items

There were no material adjusting items in the period. In H1 2024 there were £30m of adjusting items primarily related to Group restructuring, supply chain consolidation and the closure of 39 standalone Benchmarx branches.

Segmental performance

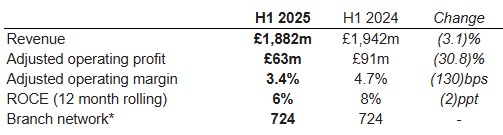

Merchanting

* 2024 branch network figures for comparison are taken at 31 December 2024

Note - all figures above exclude property profits

Trading conditions in the majority of the Merchanting segment's end markets remained subdued which, allied to a loss of market share in the first quarter and a (1.0)% impact from one fewer trading day, saw revenue down by (3.1)% in the first half. Overall pricing was broadly flat as modest manufacturer increases were offset by a competitive trading environment.

Management implemented a series of actions seeking to reverse the loss of market share, including targeted promotions and incentives and the addition of resources back into customer-facing roles to improve service levels. These actions have improved the trading performance with Q2 like-for-like revenue down (1.0)% compared to a decline of (3.2)% in Q1. This continues a trend of improving performance in the Merchanting businesses post significant leadership and technology changes as shown below:

Adjusted operating profit reduced by (31)% to £63m with adjusted operating margin decreasing by (130)bps. Whilst costs in the Merchanting businesses were well controlled, profitability was impacted by further volume decline and pressure on gross margin in a highly competitive environment.

Merchanting sales through the yard (around 80% of revenue) returned to growth of 2%** in Q2 (flat** for the first half overall) while direct-to-customer sales (around 20% of revenue) were in notable decline, down (11)%** in the first half. The challenges with direct sales arose after the implementation of Oracle in 2024. Significant progress has been made through an increased focus on training and a resolution of the invoice backlog which has eased the burden on front-line colleagues. Further technology fixes are now being deployed to enhance direct sales functionality and provide the same level of flexibility in service that existed prior to Oracle.

** Trading day adjusted

There was minimal change to the Merchanting network in the first half, reflecting disciplined capital investment in a challenging market environment, but also a clear focus on protecting operational capacity and capability to ensure that the business is able to fully benefit from a future market recovery.

In May, the Group sold its specialist floor kit, i-joist and staircase manufacturer Staircraft to Gait Consulting for provisional cash consideration of £24m. This sale was part of a continued focus on simplifying the Group's operating model.

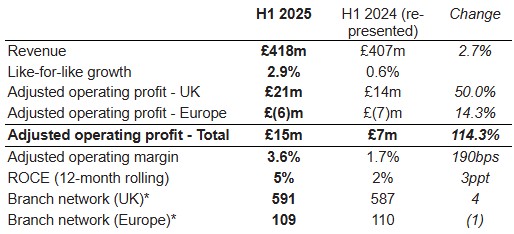

Toolstation

* 2024 branch network figures for comparison are taken at 31 December 2024

Note - all figures above exclude property profits and are for continuing businesses only. The Toolstation France business is treated as a discontinued operation.

UK

Toolstation UK delivered another strong performance in the first half with further market share gains as sales were up 5%**, driven by modest price inflation and good volume growth. Network expansion continues at a steady pace with the network increasing by four stores in the first half and expected to increase by around ten stores for the full year.

UK adjusted operating profit grew by 50% to £21m, with operating margin expanding by 180bps to 5.7% driven by further improvements in the gross margin mix and supply chain efficiencies.

Benelux

Toolstation Benelux generated losses of £(6)m in the first half, a slight improvement on the prior year. Whilst store generated sales (on a like-for-like basis) were up 6% and overheads well controlled, planned work to significantly upgrade the Benelux customer website during the first half caused significant disruption to trading with online sales down by (22)% during the period. With the enhanced website now fully operational performance is expected to improve in the second half, albeit the Dutch and Belgian markets remain similarly subdued to the UK.

** Trading day adjusted

Financial Performance

Revenue analysis

Pricing has stabilised in the Merchanting business after a prolonged period of deflation but volumes remain subdued. There was one fewer trading day than in the prior year.

Toolstation delivered good like-for-like volume growth as the business continues to mature and enhance its customer proposition. The growth from new stores in the UK was broadly offset by the closure of underperforming stores in Benelux in the prior year.

Property

The Group generated property profits of £1m in the first half of the year, with £10m of cash proceeds (2024: £18m).

Finance charge

Net finance charges were in line with prior year.

Taxation

The tax charge before adjusting items was £13m (2024: £19m) giving an adjusted effective tax rate (adjusted 'ETR') of 32.2% (standard rate: 25.0%, 2024 re-presented: 31.0%). The adjusted ETR rate is higher than the standard rate due to the effect of expenses not deductible for tax purposes, the largest item being unutilised overseas losses. The statutory tax charge for the six months to 30 June 2025 was £11m (2024: £11m) giving an effective tax rate of 29.1% (2024 re-presented: 43.0%).

Earnings per share

The Group reported a profit after tax from continuing operations of £26m (2024: £16m), resulting in basic earnings per share of 12.5 pence (2024: 7.4 pence). Diluted basic earnings per share from continuing operations were 12.4 pence (2024: 7.3 pence).

Adjusted profit after tax was £28m (2024: £42m), resulting in adjusted earnings per share of 13.3 pence (2024: 19.9 pence). Diluted adjusted earnings per share were 13.2 pence (2024: 19.6 pence).

Funding

In March 2025 the Group issued £125m of US private placement notes with the proceeds used to fund a tender offer to repurchase £125m of the Group's guaranteed notes at par.

As at 30 June 2025, the Group's committed funding of £800m comprised:

- £125m guaranteed notes due February 2026, listed on the London Stock Exchange

- £75m bilateral bank loan due August 2027

- A revolving credit facility of £375m, refinanced in November 2023 and maturing in November 2028

- £225m of US private placement notes, maturing in tranches between 2028 and 2035

As at 30 June 2025, the Group had undrawn committed facilities of £390m (31 December 2024: £390m) and deposited cash of £289m (31 December 2024: £200m), giving overall liquidity headroom of £679m (31 December 2024: £590m).

View the results presentation here

Source : Travis Perkins plc

Image : Travis Perkins plc

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.