UK DIY News

Wickes Notes Strong Profit Growth; Guidance Unchanged

- Strong profit growth driven by increase in volumes across both Retail and D&I

- FY25 expectations unchanged

Wickes Group Plc has published Interim Results for the 26 weeks to 28 June 2025.

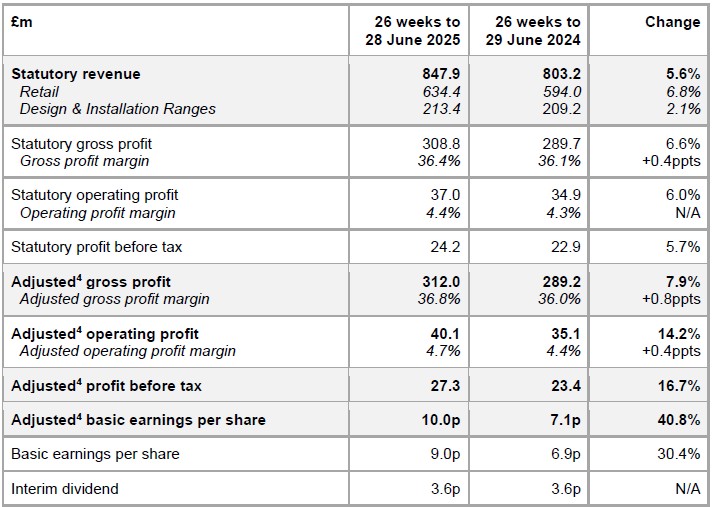

Financial Summary

- Total revenue of £847.9m (H1 2024: £803.2m) +5.6% year-on-year

- Continued strong volume growth in Retail1 with revenue +6.8%; Self-help actions in Design & Installation2 driving return to LFL growth3 in Q2

- Adjusted profit before tax4 +16.7% to £27.3m (H1 2024: £23.4m) reflecting revenue growth, operational leverage and productivity savings

- Statutory profit before tax of £24.2m (H1 2024: £22.9m)

- Net cash position of £158.0m (H1 2024 £152.4m) after £24.8m returned to shareholders

- Interim dividend declared of 3.6p (H1 2024: 3.6p)

- £20m share buyback programme ongoing

Strategic Highlights

- In Retail, volume-led revenue growth driven by 10% TradePro sales growth, with increase in active members5 to 615,000 (H1 2024: 541,000), combined with mid-single digit growth in DIY sales

- Record Retail market share6 with particular gains in timber, garden maintenance and decorating

- Strong project volume growth in Design & Installation, driven by actions taken to enhance customer experience

- Digital investments underpin growth and productivity

- 1 new store opened in a former Homebase site and 4 refits/refreshes completed. Good progress on plans for 5-7 new stores and 10-15 refits/refreshes in 2025

- UK’s #1 retailer in Financial Times Europe’s Best Employers 2025

Current Trading & Outlook

Trading in Q3 so far has been in line with expectations. The phasing of increased people costs and new stores will impact more fully in H2; our technology investment in SaaS projects7 will increase P&L costs by c£10m on a full year basis. Notwithstanding these cost increases, our strong first half performance and ongoing productivity programme mean that we remain comfortable with current consensus expectations8 for adjusted PBT in 2025.

Our Q3 trading update will be released in late October. An investor insight event will take place on 14 October, focused on our Design & Installation business, with further details to follow in due course.

David Wood, Chief Executive of Wickes, commented:

“Wickes has delivered a strong first half, with volume growth across the Group. I would like to thank all of my colleagues for their continued hard work and dedication, providing outstanding customer service and helping the nation feel house proud.

“In Retail, we have achieved record market share growth and have prioritised convenience, choice and speed, helping grow TradePro sales by a further 10%. With DIY, our focus on broadening appeal and innovating in strategic categories has seen more customers choose Wickes to bring their home improvement projects to life. In Design & Installation, the actions we undertook to enhance the customer experience have seen us return to like-for like sales growth, ahead of the wider market for big ticket items.

“Our proven strategy is working. Whilst we remain mindful of the cost headwinds facing the sector as a whole, continued investment in our growth levers and digital initiatives means we are well positioned for the future and remain comfortable with market expectations for the full year”.

Summary of full year financial results

Business review

Market

The UK home improvement sector represents a large and attractive market of c. £27bn9. Within this market we have a significant opportunity for long-term growth, given our relatively small market share of around 6%. The challenging trading conditions of the last two years have resulted in the exit and/or restructuring of retailers such as Homebase, Carpetright, CTD Tiles and Wilko, presenting an opportunity for strong businesses of scale, such as Wickes. The market has grown at c. 2.5% per annum on average over the past ten years, driven by the high average age of the UK’s housing stock, the rising number of UK households and increasing home ownership. Specialist DIY sales are forecast to grow by 2.6% per annum between 2025 and 2030, according to Mintel10 driven by improved confidence and expected improvement in the housing market.

There are a number of macroeconomic trends which affect our market. Whilst the Wickes home improver customer base has not been immune from cost of living pressures (such as increased mortgage rates or rents), they tend to be slightly older and more affluent than the UK average. Moving house is often a trigger to undertake major home improvement projects over time and the rate of UK housing transactions remains stable on an underlying basis11. Wickes has virtually no exposure to civil engineering or the new-build housing market, given that our customers are mostly home improvers and independent tradespeople. Consumer confidence in the UK has remained subdued and savings rates remain high12 with consumers cautious of undertaking major home improvement projects.

Britain’s 29.8m13 homes are among the least energy efficient in Europe, losing heat up to three times faster than in continental Europe14. The average household energy efficiency rating for England and Wales is band D15 and the UK government estimates that 33% of homes with a loft do not have loft insulation13. At Wickes we are committed to helping our customers improve the energy efficiency of their homes and save money on their energy bills.

Our August 2025 Mood of the Nation survey showed that planned spend by UK consumers on a new kitchen or bathroom remains below historical norms, but stable over recent months. The survey also showed that local trade professionals remain busy, with 1 in 4 having a pipeline of work of more than 12 months. For DIYers it showed that there is continued interest in home improvement but with a focus on smaller projects. Convenience and speed are becoming increasingly important, with almost 60% of customers expecting faster deliveries and also prepared to pay more for same-day service16

Progress against strategic growth levers

The company’s strategy, as outlined at the time of the 2021 demerger, has delivered strong operational progress centred around developing and extending the Group’s growth levers. These contribute to an improvement in our products and services, saving our customers time and money. Continued investment in the following growth levers will drive further market share growth in the coming years:

1. Winning for trade

2. Accelerating Design & Installation

3. DIY category wins

4. Store investment

5. Digital capability

6. Enhanced store service model

7. A winning culture

1. Winning for trade

Our TradePro membership scheme continues to attract local traders, who choose Wickes for its strong value credentials and simple discount scheme, high quality products, availability on the lines that matter most, as well as the convenience of our Click & Collect service, which has now been enhanced from 30 minutes to just 15 minutes.

Sales from TradePro members increased by 10% year-on-year in H1 2025. The strong growth in the number of active customers to 615,000 was partially offset by a slight decline in average basket size as tradespeople have been managing their material quantities more carefully. TradePro members benefit from our rewards programme, with access to special deals on services such as skip hire, insurance and media subscriptions.

We continue to use behavioural analytics to understand the drivers of average spending by decile. Our proprietary and market-leading machine learning model, the Mission Motivation Engine (MME), drives deeper customer relationships and extracts greater lifetime value.

2. Accelerating Design & Installation

The positive momentum within Design & Installation has continued. Following the actions taken in H2 2024 to enhance our customer offer, we achieved a third consecutive quarter of ordered sales17 growth in Q2 2025 and the first quarter of positive LFL delivered sales18 growth since Q2 2023.

This improvement has been driven by the enhancements we have made to the business in what has remained a challenging market. In response to customer feedback, we have simplified the customer journey and now present a unified Wickes Kitchens and Wickes Bathrooms offering, rather than separate Bespoke and Lifestyle paths. This new approach encompasses brochures, website, advertising and promotions. We have streamlined the customer journey in store by ensuring that new customers are able to interact directly with a Design Consultant as soon as they begin the design process, and by increasing the availability of Design Consultants. Customers are now able to book an appointment instantly with a Design Consultant, through our website, in the store of their choice, replacing a more cumbersome telephone booking system. We also use a technological solution for scheduling installers, with our Customer Experience Centre overseeing the multi-stage installation process.

We have launched a number of strategic initiatives for 2025 and beyond, such as range enhancements into high-end kitchen appliances such as SMEG.

The launch of eight new colour choices in our Lifestyle kitchens range has 4 expanded our breadth and enabled us to capture new customers, such as those seeking pastel colours, like Ohio Pink. We are preparing to launch a Paint to Order service for kitchen cabinets this autumn to offer further choice.

Wickes Solar is now sold in our entire store estate. We have installed gondola-ends in prominent locations displaying solar panels, batteries and inverters for customers to see and touch, as well as smaller point-of-sale materials around the stores and in the areas where customers sit with Design Consultants. These physical changes, in combination with the digital journey on the Wickes website, have led to Wickes-generated leads now representing over 80% of total Wickes Solar installations. Around 100 Wickes Design Consultants have now been trained to offer Wickes Solar in store and in the home, which is proving popular in a market where customers particularly value face-to-face advice.

The market for domestic solar installations in the UK is in long-term growth, with the market estimated to be worth £1.5bn pa by 202819. It is a highly fragmented market with no clear brand leader. With a trusted brand and significant experience in design and installation services at scale, Wickes is well-placed to be a market leader in home energy solutions. We have an option to purchase the remaining 49% of the issued share capital of Solar Fast by May 2029, in tranches of not less than 10% of the issued share capital, based on a valuation of 6x the last twelve months EBITDA at the time.

3. DIY category wins

Our market share in Retail has reached record levels, with strength across numerous categories, particularly in timber, garden maintenance and decorating.

Wickes continues to appeal to an ever broader audience as we grow our key strategic categories. Paint is a gateway category, which features in the majority of home improvement projects. This year we have further evolved our ‘colour valley’ in order to maximise our market share growth opportunity by improving the colour choice proposition for DIY customers. This has involved re-flowing our decor bays and has enabled us to increase capacity. This has created additional space for colour mixing, which is now also available online. We have had a full range review of decorative attachment categories, covering brands and price architecture. Other range reviews have included lighting (introduction of matt black downlights, new solar energy range), locks (introduction of new finishes), more Wickes branded nuts & bolts, new Pro Wickes power tool range, flooring (new moisture-resistant laminate range), tiling and radiators (new products online).

Our Customer Satisfaction metrics are very strong, with 85% of customers responding that our Click & Collect service was ‘excellent’ or ‘good’ and 85% of customers responding that their home delivery was ‘excellent’ or ‘good’.

We continue to focus on what matters to our customers, namely the importance of convenience, choice and speed. Our Click & Collect promise has recently been enhanced from 30 minutes to just 15 minutes. Our Wickes Extra range offers customers easy access to our extended range online. The recent launch of Wickes Rapid enables customers to place orders of up to 800kg for local delivery to their home or site within three hours. This highly differentiated service, with a specialist partner, is available seven days per week on over 10,000 SKUs.

4. Store investment

Investment in our store network continues, to modernise the stores, improve our showrooms and create additional fulfilment space.

Our refit programme continues to deliver good returns with strong sales uplifts, particularly from the Design & Installation areas, where we are able to showcase our full offer of kitchens and bathrooms. The refits enable us to upgrade the efficiency of multi-channel order pick and despatch, which drives sales densities, underpins our new 15-minute Click & Collect promise and increases customer satisfaction metrics. 186 stores, or 82% of the network, are now in our new format, with one store refitted in H1 2025 and a further three refreshed.

Our new store opening programme is performing well and we expect our new stores to deliver good economic returns, once mature. One new store opened during H1 2025 in Leeds Moor Allerton, which is a former Homebase store. During H1 2025 we closed one store (Muswell Hill Kitchen & Bathroom) and ended the period with 228 stores. Since the period end we have opened new Wickes stores in a further two former Homebase sites, in Bury St Edmunds and Dunfermline.

Our property plans for the remainder of H2 2025 are on track. These include the opening of another former Homebase store in Northampton. We are planning a total of 10-15 refits/refreshes in the year and 5-7 new stores. We have an exciting pipeline of new stores planned for the coming years, as we target an overall estate of around 250 stores over the medium term.

5. Digital capability

We continue to invest in our digital capabilities to underpin enhanced customer experience and productivity.

A number of the initiatives undertaken in recent years continue to drive growth, such as the introduction of direct-todiary booking by customers for their appointment with a Design Consultant, which has greatly improved the proportion of leads that continue through the sales funnel. Our proprietary and market-leading machine learning model, the Mission Motivation Engine (MME), delivers tailored content to customers to help them complete their home improvement missions and this continues to drive incremental revenue. New and improved functionality in our colleagues’ handheld devices has enabled us to achieve faster fulfilment times and thereby start offering a 15 minute Click & Collect service, instead of 30 minutes, as well as launching the Wickes Rapid service.

Our ongoing digital investments are also driving significant productivity benefits, such as the AI-driven predictive stock forecasting platform, which is delivering materially enhanced productivity whilst driving an enhanced customer experience and lower costs. The platform has led to a significant improvement in stock forecast accuracy with material financial benefits. We have delivered a reduction in total stock units held, a c.70% reduction in third party storage usage over two years and improved store availability alongside the reduction in stock levels. For our Design & Installation business, the FSM scheduling tool which we introduced last year has resulted in an enhanced customer experience and reduced costs.

There are a number of projects which we are currently investing in to drive future growth, such as our new design software. This will be rolled out to all Wickes design consultants in time for the Winter Sale 2025/26 and will transform the customer experience by unlocking new capabilities for faster, more inspirational design visualisations. In H2 2026 we will transform our till systems into a unified commerce platform for a seamless online/in-store customer experience and for improved store inventory management. We will implement an order management system to simplify our ordering and fulfilment capabilities and improve customer order accuracy, in two phases launching in H1 2026 and H2 2027.

6. Enhanced store service model

Our ‘4C’ model aims to meet our customers’ needs through all four of our store network journeys: Self Serve, Assisted Selling, Order Fulfilment and the Design & Installation showrooms. Our approach offers a seamless shopping experience for customers and ensures that our store estate works hard for us. Recent changes to the store estate have increased back of house capacity for Click & Collect and Home Delivery Order Fulfilment, while reducing the impact on customers in the store.

7. A winning culture

We are proud of the Wickes culture which over the past fifty years has evolved to become a modern, inclusive workplace where all colleagues can feel at home and have the opportunity to grow their skills and develop their careers. We continue to engage with colleagues so that they are informed, inspired and motivated to play their part in delivering our strategy through exceptional levels of customer service.

We are proud that Wickes has been voted the number 1 UK retailer in the Financial Times survey of Europe’s Best Employers 2025 and was ranked #87 out of 1,000 companies.

Source : Wickes

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.