UK DIY News

Wickes: Strong H1 Sales Growth In Retail

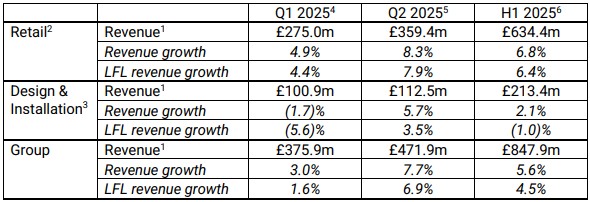

- Strong H1 sales growth in Retail; return to positive LFL in Design & Installation in Q2

- Comfortable with market forecasts for 2025 adjusted PBT

Wickes Group plc has published a Trading Update for the six months ending 28 June 2025.

In the first half of 2025 we have delivered volume-led growth momentum across all areas of the business. Overall Group revenue1 increased in the period by 5.6% year-on-year. Retail sales2 continued to perform well with revenue up 6.8%. In Design & Installation3, the return to LFL sales growth in Q2, as expected, has resulted in H1 Design & Installation revenue improving by 2.1% year-on-year.

This has been a period of strong sales growth for Retail, driven by an increase in volumes while pricing remained broadly stable. In particular, we successfully fulfilled strong customer demand across timber, garden maintenance and decorating, which saw us further increase our market share during the half to record levels.

Within Retail, the performance of TradePro remained strong, with sales up 10% year-on-year, as local trade professionals continue to choose Wickes to save them time and money. Active TradePro members7 have increased by 14% year-on-year to 615,000. DIY sales were in mid-single digit growth, with volumes driven by increasing customer transactions. Our performance in the first half reflects the strength of the Wickes offer, with Q2 trading further assisted by the warm spring weather and the timing of Easter. As we move into the second half of the year, the prior year comparative gets tougher.

The positive momentum within Design & Installation has continued8. Following the actions taken in H2 2024 to improve our customer offer, we achieved a third consecutive quarter of ordered sales growth9 in Q2 2025 and the first quarter of positive LFL delivered sales10 growth since Q2 2023.

In addition, investment in our strategic growth levers continues, with 5-7 new stores planned for 2025. Four of the openings in our 2025 new store pipeline are former Homebase stores, of which the first opened in Leeds Moor Allerton in June and the second in Bury St Edmunds in July. Our successful refit programme continues, with one store refitted in the half (c.82% of the store estate now in the new format) and a further three refreshed. As previously communicated, in 2025 we are stepping up the level of investment in technology to enhance the customer experience further and to support productivity initiatives, positioning us for profitable growth in the next few years.

The balance sheet remains strong with net cash at the half year of £158.0m (2024: £152.4m). This balance is following £8.1m used during the first half in our ongoing £20m share buyback programme11 and £11.9m in share purchases made for the Employee Benefit Trust11.

The actions we have taken to invest in our growth levers and digital initiatives have set us up well for a successful 2025. While the business continues to face into the significant cost headwinds seen across the retail sector, our ongoing productivity programme and the strong first half performance means that we remain comfortable with current consensus expectations12 for adjusted PBT in 2025.

We expect to report half year results in mid-September 2025.

David Wood, Chief Executive of Wickes, commented: “In the first half of the year we have gone from strength to strength, with increased sales and record market share.

“Retail sales have grown again, driven by volumes, as more people shop with us, both in-store and online. In Design & Installation, the actions we took to improve the customer proposition are driving project order volumes and as a result we have returned to sales growth.

“The continued investment in our growth levers underpins our market outperformance and leaves us well placed for the future as we target further profitable growth and value creation for shareholders.”

Source : Wickes

Image : Wickes

I find the news and articles they publish really useful and enjoy reading their views and commentary on the industry. It's the only source of quality, reliable information on our major customers and it's used regularly by myself and my team.