UK DIY News

Barclays: July Card Spending Grew By 1.4%

- Clothing performed strongly, up 4.2 per cent, contributing to a 1.9 per growth in retail

- Confidence in household finances held strong at 72 per cent, after reaching a four-month high in June

- One in three consumers are using AI tools such as ChatGPT to support planning and budgeting, rising to seven in 10 among Gen Z

- Live shows and concerts rose 9.3 per cent, peaking on 10th July, when general release tickets to Lewis Capaldi’s 2025 tour went on sale

- The Barclays Consumer Spend report combines hundreds of millions of customer transactions with consumer research to provide an in-depth view of UK spending

Consumer card spending grew 1.4 per cent year-on-year in July, up from -0.1 per cent in June, but remaining below the latest CPIH inflation rate of 4.1 per cent. Essential spending declined -0.7 per cent, however discretionary spend rose by 2.4 per cent – an increase from June’s 0.8 per cent growth – as changeable weather led shoppers to spend on both sunny and rainy-day activities and items.

The overall retail category had a positive month, up 1.9 per cent, after marginal growth of 0.2 per cent in June. This was propped up by clothing which grew 4.2 per cent, its greatest increase since September 2024. This comes as almost one in five (16 per cent) UK adults said they bought more summer clothes and accessories in July, while a quarter (26 per cent) said July's changeable weather impacted their spending decisions.

The growth in online retail spending (excluding groceries) reached 4.9 per cent, up from 2.4 per cent in June. Shoppers made the most of discounted items and sales events, with a fifth (21 per cent) spending more than they had expected and 11 per cent planning ahead by purchasing early Christmas gifts.

Pharmacy, health and beauty performed strongly, up 9.8 per cent, while continuing to benefit from the enduring post-COVID “lipstick effect” – where shoppers turn to small and affordable luxuries to boost their mood. Furniture store sales also increased by 6.7 per cent, marking the category’s eighth consecutive month of growth.

Confidence in household finances holds strong

Confidence in the strength of the UK economy dipped once again in July, falling three points month-on-month, to 22 per cent, the lowest level seen since January (21 per cent), having reached a 2025-peak in May, at 28 per cent. Despite this, consumers remain confident in their ability to live within their means. This measure held firm at 75 per cent, just one point below the 76 per cent recorded in June, and five percentage points higher than July 2024 (70 per cent). Confidence in household finances also stabilised at 72 per cent, down marginally from 73 per cent in June, but up seven percentage points year-on-year, from 65 per cent.

A focus on budgeting is likely contributing to the stability of these figures. A third (34 per cent) are building a savings buffer in case costs rise (equal to June), while seven in 10 (71 per cent) have been making financial adjustments in light of the current economic outlook (up two points month-on-month).

Gen Z leading AI money management

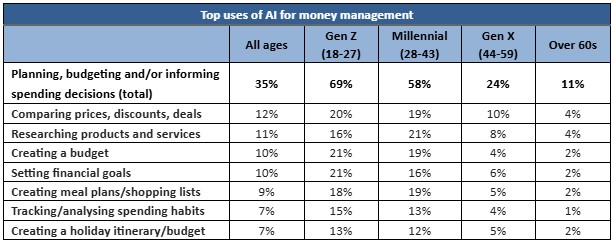

Amid the meteoric rise of artificial intelligence tools such as ChatGPT and Gemini, consumers are making use of AI to help with managing their money. Over a third (35 per cent) of UK adults have used AI tools to help them plan, budget and/or analyse their spending, rising to seven in 10 (69 per cent) among Gen Z.

Gen Z also turn to AI the most frequently for money management, with almost half (45 per cent) of users reporting weekly use and 84 per cent using the tools at least once month. Across all age groups, the most popular use cases are to: compare prices, discounts and deals (12 per cent); research products and services (11 per cent); and create budgets (10 per cent).

Live shows lift entertainment

Entertainment spending was up 7.4 per cent in July, below June’s 8.0 per cent, but ahead of the overall hospitality and leisure sector’s 2.7 per cent growth. Spending on live shows and concerts increased 9.3 per cent, above the 2.5 per cent recorded in June. The busiest day of the month for the category was 10th July, when general release tickets to Lewis Capaldi’s 2025 tour went on sale. Cinema spend, up 1.6 per cent overall, peaked on 5th July, following the release of Jurassic World Rebirth a few days earlier, on 2nd July.

Small screen viewing resulted in an 8.0 per cent uplift for digital content & subscriptions, helped by nostalgic fans streaming the live action remake of Lilo & Stitch and highly-anticipated sequel Happy Gilmore 2.

Karen Johnson, Head of Retail at Barclays, said: “The summer sales, changeable weather and shoppers seeking the “feel-good factor” led to a strong July for retailers, particularly among beauty, clothing and furniture stores. While confidence in the UK economy remains subdued, prudent money management, supported by the growing popularity of AI tools to help with budgeting is contributing to a continued resilience in personal and household finances”.

2025 consumer confidence measures

| Jan | Feb | Mar | Apr | May | Jun | Jul |

Household finances | 70% | 75% | 70% | 70% | 67% | 73% | 72% |

Job security | 47% | 48% | 46% | 48% | 47% | 50% | 48% |

Non-essential spending | 56% | 59% | 58% | 60% | 56% | 59% | 58% |

Ability to live within means | 74% | 77% | 73% | 74% | 74% | 76% | 75% |

Strength of UK economy | 21% | 25% | 23% | 24% | 28% | 25% | 22% |

Strength of European economy | 25% | 28% | 30% | 27% | 30% | 27% | 25% |

Strength of global economy | 21% | 26% | 24% | 21% | 26% | 23% | 21% |

Overall growth figures

Spend Growth | Transaction Growth | |

Essential | -0.7% | -0.3% |

Non Essential | 2.4% | 1.4% |

|

| |

OVERALL | 1.4% | 0.7% |

Retail | 1.9% | 1.6% |

Clothing | 4.2% | 6.1% |

Grocery | 0.9% | 1.2% |

| 0.6% | -0.5% |

| 3.1% | 9.3% |

Household | 0.0% | 1.0% |

| -0.8% | -7.4% |

| -4.3% | 9.1% |

| 6.7% | 0.9% |

| 0.1% | -2.3% |

General Retailers | 3.1% | 2.9% |

| 6.8% | 5.1% |

| -7.4% | -2.0% |

| -2.7% | -2.3% |

Specialist Retailers | 4.0% | -0.5% |

| 9.8% | 0.5% |

| -1.3% | -1.1% |

| 1.3% | -1.5% |

Hospitality & Leisure | 2.7% | -0.7% |

Digital Content & Subscription | 8.0% | 3.9% |

Eating & Drinking | 0.8% | -2.5% |

| 1.9% | -0.7% |

| -0.4% | -2.1% |

| 0.1% | -5.0% |

Entertainment | 7.4% | 7.1% |

Hotels, Resorts & Accommodation | 1.4% | -1.8% |

Travel | 2.9% | -2.0% |

| 2.0% | 15.9% |

| 4.7% | -6.6% |

| 0.5% | -6.6% |

| 5.0% | 6.1% |

Other | -2.5% | 0.9% |

Fuel | -7.8% | -3.7% |

Motoring | -1.1% | 6.6% |

Other Services | -0.4% | 2.8% |

Insperiences | 3.8% | -0.5% |

|

|

|

Online | 2.7% | 3.8% |

Face-to-Face | 0.2% | -0.5% |

Source : Barclays

Image : shutterstock / 1137631598 / William Barton 2

Thank you for the excellent presentation that you gave at Woodbury Park on Thursday morning. It was very interesting and thought-provoking for our Retail members. The feedback has been excellent.