UK DIY News

Lords Says It Is 'Well Positioned For Market Recovery'

Lords (AIM:LORD), a leading distributor of building materials in the UK, today announces its Final Results for the year ended 31 December 2024 (‘FY24’ or the ‘year’).

FY24 Financial Performance

FY24 Highlights

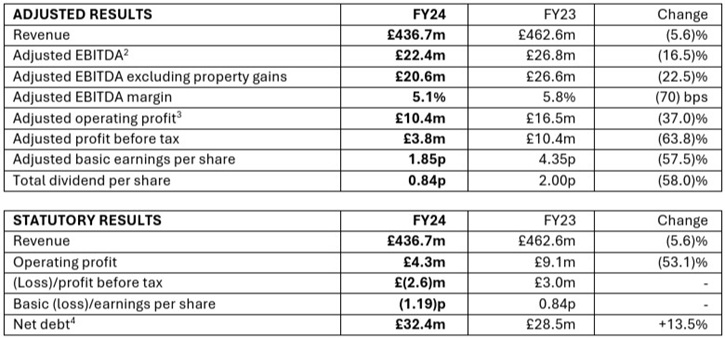

- Group revenue of £436.7 million (FY23: £462.6 million)

* Merchanting like-for-like1 revenue 3.6% lower; recovering strongly in H2 with revenue growth of 2.3% against prior year comparative period

* Plumbing and Heating (‘P&H’) revenue 10.2% down in line with boiler volumes in the UK market

* Strong growth in sales of renewable products, up 99% to £5.5 million, supported by the acquisition of Ultimate Renewables Supplies in October 2024

- Continued progress against strategy to deliver margin accretive growth by opening new branches, extending the Group’s product range and expanding digital revenues

* New exclusivity agreements with leading global boiler manufacturers (Navien) and Air Source Heat Pump producers (Clivet) broadening product range

* Three new branch openings in 2025 to date

* Further investment in Merchanting’s digital team with website upgrades to improve customer experience - Decisive management actions taken on overheads delivered like-for-like efficiency savings of £3.7 million during the year whilst ensuing excellent customer service continues to be delivered

- Adjusted EBITDA2 resilient at £22.4 million (FY23: £26.8 million)

- Final proposed dividend of 0.52 pence per share, scaled in line with earnings per share (FY23: 1.33 pence per share)

Current Trading and Outlook

- Strong like-for-like revenue performance during Q1 FY25

* P&H Q1 FY25 revenue 22% above a weak Q1 FY24 and benefiting from a pull forward of boiler volumes ahead of industry-wide price increases on 1 April 2025

* Merchanting Q1 FY25 revenues 11% ahead of Q1 FY24 - Sale and leaseback of four properties for £13.1 million completed in H1 2025 providing additional liquidity to leverage growth opportunities as the market recovers

- Board expectations for full year unchanged.

Percentages are based on underlying, not rounded, figures.

1 Like-for-like sales is a measure of growth in sales, adjusted for new, divested and acquired locations such that the periods over which the sales are being compared are consistent.

2 Adjusted EBITDA is EBITDA, inclusive of property gains and losses, (defined as earnings before interest, tax, depreciation, amortisation and impairment charges) excluding adjusting items (note 5).

3 Inclusive of property gains and losses.

4Net debt is cash less borrowings before lease liabilities at 31 December 2024 and is therefore stated prior to the H1 FY25 property sale and leaseback to realise cash proceeds of £13.1 million.

Shanker Patel, Chief Executive Officer of Lords, commented: “Against a challenging market backdrop in 2024, Lords delivered a resilient performance. We continue to focus on what is within our control: managing costs, driving efficiencies, reducing debt and pragmatically supporting strategic initiatives to deliver organic and acquisitive growth.

“Whilst the strength and timing of the anticipated recovery in the UK construction market remains uncertain, the medium-term market drivers are positive. The recent property transaction has strengthened our balance sheet and Lords is well positioned to invest in organic growth and selective acquisitions. A strong start to FY25 gives the Board confidence of delivering an improved financial performance for the full year.”

Source : Lords

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.