UK DIY News

PwC: Consumer Sentiment Holds Steady Ahead Of Golden Quarter

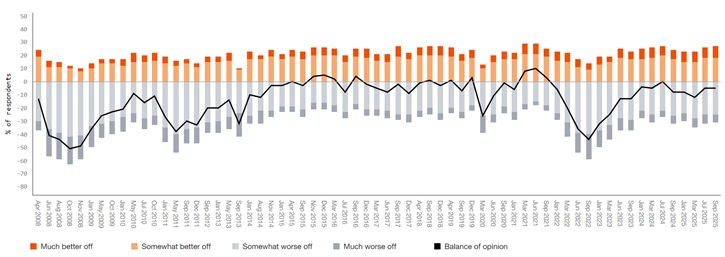

- Consumer sentiment in the UK remained flat at –5, unchanged from the level recorded at the beginning of July

- Sentiment amongst 25 to 34-year olds and the AB socioeconomic group drops from summer

- Nearly nine out of ten (85%) consumers are worried about inflation, up from the summer

- One in five (20%) say they have started shopping for Christmas, slightly down compared to this time last year

PwC’s latest Consumer Sentiment Survey shows consumers remain cautious about spending, with confidence remaining at the same level as PwC’s last pulse check in the summer. As the Golden Quarter for retail approaches, the findings show concerns about inflation remain high while sentiment among 25 to 34-year-olds and within the AB socioeconomic group has fallen over the last quarter.

The survey, a barometer of consumers’ spending intentions, recorded an index score of –5, the same score as the previous quarter. While the score is better than the long-run average (-15), it remains below the highs seen in early 2024 and directly following the summer 2024 UK General Election. A stable index score suggests stability; however, the findings show some shifts across different demographics with sentiment improving slightly for most age groups and socioeconomic groups but falling for 25 to 34-year-olds (-17 points) and the most affluent AB segment (-19 points).

While the sentiment index score stayed level, anxiety about household finances is rising, with 85% saying the rising cost of everyday things is a concern, up slightly from the summer and higher across every demographic group since the start of the year.

Cautious Consumers

The squeeze on living costs is causing consumers to rethink their spending habits despite real earnings being 5% higher than at the beginning of 2020. According to PwC’s latest Economic update, UK households have been slower than their G7 peers in unwinding the savings accumulated during the pandemic. While most advanced economies have seen household savings ratios fall back to, or even below, pre-pandemic levels, the UK stands out as an exception. As of 2024, the UK savings ratio - a measure of disposable income not spent on final consumption - has doubled to 5.1pp above its 2017/19 average – the largest increase among its G7 peers.

This cautious approach is further evidenced by the number of consumers who say they are planning to cut back spending over the next three months rising slightly to almost three quarters (73% of all adults from 71% in the summer), with this intention being more prevalent amongst younger and lower income groups. Of those planning to cutback, almost two-fifths (39%) said they would be making fewer purchases, more than a third said they would be trading down or buying cheaper items in the same store, and more than a quarter (26%) said they will do so by visiting a cheaper store for some or all of their grocery shopping.

Sam Waller, Leader of Industry for Consumer Markets at PwC UK, said:

“Consumer sentiment may have stabilised, but the underlying caution in spending remains. As we enter the final quarter of the year, businesses need to understand not just what consumers are buying, but why they’re holding back. The data shows that concerns around inflation and household finances are still shaping behaviour, even as earnings improve. Unlocking the hesitancy in consumer spending will boost both retailers and the economy.”

Future Spending Plans and Christmas

Spending intentions (intention to spend less vs intention to spend more compared with the previous 12 months) are in negative territory across all categories except grocery shopping (+30). Grocery shopping has a positive net spend intention by some distance compared to other categories, although this is driven by inflation expectations. In terms of spending by age group, intentions vary widely, with under 35s more willing to increase discretionary spending in categories such as health & wellbeing, beauty and technology.

Consumers were asked when they plan to carry out most of their Christmas shopping. The findings show shopping has not started as early as last year with 21% saying they had already started compared to 25% at the end of September last year, indicating more consumer caution. However, although people expect to spend less on Christmas (28%) than spend more (21%), net spending intention is better in 2025 (-7) compared with last year (-12).

Jacqueline Windsor, Head of Retail at PwC UK, said:

“As we enter the Golden Quarter, retailers face a delicate balancing act. Protecting margin while unlocking growth will require a renewed focus on value, quality and customer loyalty. With consumer sentiment holding steady but caution persisting, businesses must watch their back - particularly as inflation and job security continue to weigh on purchasing decisions. Defending market share will reflect how well retailers adapt to shifting behaviours, especially among younger and lower-income groups. Those who can deliver value without compromising experience will be best placed to navigate the months ahead.”

Source : PwC

Image : DragonImages / iStock / 1215683452

Insight DIY is the only source of market information that I need and they always have the latest news before anyone else.