UK DIY News

Kingfisher Notes Strong H1 Performance; Upgrades Profit Guidance

- Strong H1 performance

- Upgrading full year profit & free cash flow guidance

Kingfisher has published half year results for the six months ended 31 July 2025 (unaudited).

Highlights

- Underlying± like-for-like sales of +1.9% (Q2: +1.4%) driven by volume & transaction growth. Underlying total sales growth of +1.5% (total sales +0.9% at constant currency and a (0.6%) calendar impact(2))

- Strong UK performance across both B&Q and Screwfix with LFL +4.4% and 3.0% respectively with improving sequential trends in France and Poland

- Market share gains(3) in the UK, France and Spain. Poland broadly in line with the market

- Continued strategic delivery with strong sales growth in trade (+11.9%) and e-commerce(4) (+11.1%)

- Improved quarter-on-quarter growth trends in core and a third consecutive quarter of big-ticket underlying growth, with strong weather-related seasonal performance led by the UK

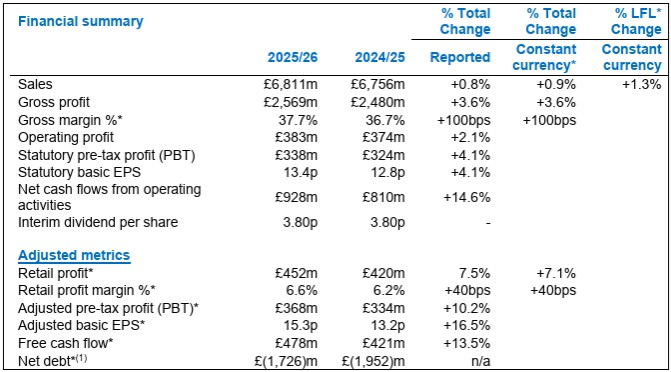

- Retail profit margin growth of +40bps to 6.6% driven by gross margin and operating cost initiatives, leading to +10.2% growth in adjusted PBT to £368m and +16.5% growth in adjusted EPS to 15.3p

- Statutory pre-tax profit growth of +4.1% to £338m

- Free cash flow of £478m (+13.5%) from earnings growth and inventory management

- Upgrading full year guidance(5) now targeting the “upper end” of FY 25/26 adjusted PBT of c.£480m to £540m, and free cash flow of c.£480m to £520m (previously £420m to £480m)

- Accelerating SBB with current £300m programme to complete by March 2026

Thierry Garnier, Chief Executive Officer, said: "We delivered a strong first half with high quality underlying like-for-like sales growth of 1.9%, driven by increased volumes and transactions. Our teams continue to execute at a high level, delivering double-digit growth in our strategic initiatives, trade and e-commerce, which supported our market share gains. We were encouraged by underlying quarter-on-quarter growth in our core categories, and a third consecutive quarter of growth in big ticket sales.

“In a higher cost environment, we remain disciplined on managing costs and cash. Our margin and operating cost initiatives combined with the positive impact of our strategic drivers enabled us to deliver 10.2% growth in adjusted PBT and 16.5% growth in adjusted EPS. Free cash flow rose by 13.5%.

“Our expectations for our markets for the year remain consistent with what we outlined in March, whilst mindful of mixed consumer sentiment and political uncertainty. Combined with our H1 performance, this gives us the confidence to upgrade our full year profit and free cash flow guidance and to accelerate our share buyback programme. We remain focused on executing our strategic priorities, maintaining cost discipline and driving shareholder returns."

Financial highlights

Solid operational execution and progress on our strategic initiatives enabled us to deliver +1.9% underlying LFL sales growth in H1, outperforming our markets. We saw sequential improvement in underlying trends in core and big-ticket categories, and robust sales growth in seasonal products due to good weather in the UK. B&Q and Screwfix both delivered a strong H1 driven by trade and e-commerce initiatives, product innovation, and transference from the closure of Homebase stores. Our France and Poland banners delivered a sequential improvement in sales from Q1 to Q2 in a subdued but improving market backdrop.

Gross margin increased by 100 basis points to 37.7%, driven by leveraging Kingfisher’s buying and sourcing scale, by margin accretive initiatives including growth from e-commerce marketplaces and retail media, improved returns on promotional activity through the use of our AI solutions, and improved inventory management and clearance activity.

We entered the year with significant cost headwinds (c.£145m) consisting of wage inflation, higher UK employer national insurance contributions, increased social taxes in France and the new packaging fees in the UK (impacting our banners at the gross margin level). We expect to fully mitigate these costs through gross margin and cost initiatives. In addition, we also received a £33m prior year benefit (H1 24/25: £24m) of one-off business rates refund in the UK. We have made good progress mitigating these headwinds in H1, and combined with H2 weighted marketing and tech spend, this resulted in retail profit growth of +7.1% to £452m, representing a 6.6% profit margin (+40bps vs H1 2024/25). At reported rates, adjusted pre-tax profit of £368m, was up 10.2% reflecting higher retail profit and lower net finance costs, partially offset by higher central costs. Statutory PBT of £338m, was up +4.1% (H1 24/25: £324m), reflecting higher operating profit and lower net finance costs. Our strong profit performance and our ongoing share buyback programme drove a 16.5% increase in adjusted EPS to 15.3p. Statutory basic EPS was up +4.1% YoY to 13.4p.

Free cashflow in H1 increased 13.5% to £478m driven by earnings growth, receipts of tax settlements relating to prior years and H2 weighted capex investment. Leverage reduced to 1.3x adjusted EBITDA (FY 24/25: 1.6x), reflecting stronger free cash flow, further supported by £94m net one-off cash inflows, primarily comprising a £64m EU state aid tax refund and £33m in net proceeds from the sale of Romania.

Strategic highlights

We have made excellent progress across all pillars of our Powered by Kingfisher strategy in H1.

Group trade sales grew +11.9% YoY to £1.9bn now representing 28.0% of Group sales as we continue to develop our trade proposition across our banners, leveraging our existing store estate. These Group initiatives involve bespoke loyalty programmes, enhanced trade specific product ranges, further roll out of trade counters, increased investment in dedicated trade colleagues and an enhanced omni-channel customer experience. We have also upgraded our trade service offerings, including customer financing, tool rental and improved fulfilment capabilities.

We continued to execute our Group strategy at pace across our banners in the half. In the UK, we onboarded 33 additional trade sales partners at B&Q, and our recently launched Tradepoint app has driven a 24.4% increase in click & collect trade sales, generating increased footfall to store. At Screwfix, we have enhanced the Sprint proposition, with delivery now available in as little as 20 minutes. In France, we have successfully rolled out our trade proposition across the Castorama estate in the past 6 months. Brico Dépôt grew trade sales by +23.8% through a combination of initiatives including recruitment of trade sales partners, membership recruitment and targeting campaigns. In Poland the new loyalty programme, launched last year, continued to resonate with trade customers with a 36% increase in membership since year end and we more than doubled the number of dedicated trade colleagues in store.

Group e-commerce sales grew by +11.1% YoY to £1.4bn with penetration(6) reaching 20.0% as we continue to evolve our digital proposition through marketplace, retail media, apps, data and fulfilment capabilities. This supports a connected digital ecosystem with the store at its core.

Across our banners, we have delivered significant enhancements to our apps, including the rollout of exclusive app-only features and personalised, targeted promotions, which are strengthening customer engagement and drive conversion. Group app sales now account for 34.3% of total group e-commerce sales, +1.4pts YoY (H1 24/25: 32.9%).

Marketplaces are now live across the UK, France, Poland, Iberia, and Turkey, with strong growth in both vendors and product offering. In H1, Group GMV(7) growth was up +62.0% to £262m (H1 24/25: £162m). We have unlocked cross-border vendor onboarding and are piloting a UK-first marketplace click & collect service at B&Q, targeting 300 stores by the end of October. B&Q marketplace GMV increased by +45.4% YoY to £228m leading to a retail profit contribution(8) of c.£7m.

Our marketplaces are driving incremental traffic that directly benefits our 1P proposition – for example, c.50% of B&Q’s marketplace customers are new to DIY.com, and subsequently, c.15% of these go on to purchase a B&Q 1P product.

Retail media continues to rapidly scale, with successful launches in Screwfix and Castorama Poland, alongside expanded offerings in B&Q, Castorama France, and Brico Dépôt France.

We continue to build a data-led customer experience, using AI and advanced technology to enhance personalisation, product recommendations, pricing, and supply chain efficiency. As part of this, we have launched Core IQ – our new data monetisation platform – in Castorama France, offering vendors deeper trading and digital performance insights.

We are building on our different banners with the opening of eight newly converted B&Q stores from former Homebase sites and the continued expansion of Screwfix stores across the UK and Ireland. In H2 we have plans to open up to 25 Screwfix UK & ROI stores.

We are pleased with progress in Screwfix France, with +52% store LFL in H1, and have plans to open up to a further 5 stores in H2.

Path to medium-term profit target in France

In 2024 we announced a plan for Castorama and Brico Dépôt France to drive the next level of our performance and profitability. The plan targets a retail profit margin for France of c.5% to 7% over the medium term, driven by a combination of self-help measures, including the restructuring and modernisation of approximately one-third of Castorama’s store network, and operating leverage from an improved market environment. Our retail profit margin in H1 improved by 20bps to 3.5%.

While we are pleased with the delivery of our plan, the French market has declined by c.10% (per GfK), since the announcement in March 2024 of our medium-term margin target of c.5-7%. We remain confident in delivering this target of c.5-7%, with the timing and trajectory of reaching this target dependent on the pace of the market recovery. Despite current headwinds, we remain optimistic on our outlook for the market in the medium-term.

Guidance for FY 25/26 – upgraded

Our expectations for our markets for the year remain consistent with what we outlined in March, whilst mindful of mixed consumer sentiment and political uncertainty. Combined with our strong H1 performance, this gives us the confidence to upgrade both our full year profit and free cash flow guidance and accelerate our recurring share buyback programme.

We now expect to deliver FY 25/26 adjusted PBT at the upper end of the previously guided range of approximately £480m to £540m. This reflects our strong profit performance in the first half, alongside second half weighted investment in marketing and technology to support our strategic growth initiatives.

Half year results for the six months ended 31 July 2025 (unaudited) We have also raised our FY 25/26 free cash flow guidance range to c.£480m to £520m, up from the previous range of £420m to £480m. This upgrade is driven by the uplift in adjusted PBT expectation, continued progress in reducing net inventory, and a second half weighted capital expenditure profile as we invest in enhancing the customer experience across both in-store and online channels to support long-term growth.

Share buyback programme – accelerated

In line with our capital allocation policy, in March 2025 the Board determined that a further £300m of surplus capital was available to return to shareholders via a share buyback programme. As of 31 July, we had repurchased £93m worth of shares under this programme. The third tranche of the programme will commence imminently. Reflecting stronger free cashflow, as outlined above, and additionally supported by £94m of one-off exceptional cash inflows, we will accelerate the current share buyback programme, with completion expected by the end of March 2026.

Download the full results publication here

Kingfisher Poland and other international

Source : Kingfisher plc

Image : Kingfisher plc

Insight DIY always publishes the latest news stories before anyone else and we find it to be an invaluable source of customer and market information.