UK DIY News

Kingfisher Upgrades Guidance Following Q3 Growth

- Strategic initiative delivery driving momentum.

- Full year profit guidance upgraded

Kingfisher plc Q3 and YTD 25/26 trading update to 31 October 2025 (unaudited)

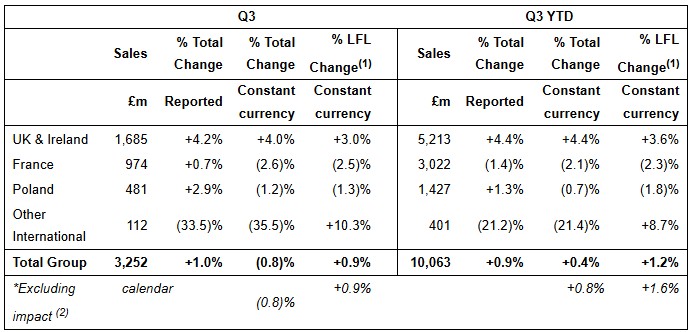

Q3 Highlights

- Underlying LFL sales of +0.9% and YTD +1.6% driven by continued volume & transaction growth

- Strong UK performance with continued market share growth(3) driving LFL sales growth of +3.0%

- Subdued consumer demand in France and Poland with banner performance in line with their markets(3)

- Strategic initiatives delivering; sales growth in trade +12.1% with penetration of 31.3% (up 3.6%pts YoY) Sales growth in e-commerce(4) +10.2% with penetration of 20.7% (up 1.9%pts YoY)

- Continued growth in core and 'big-ticket', with soft seasonal sales

- Upgrading full year profit guidance

- Share buyback - £175m(5) purchased to date. On track to complete current £300m programme by March 2026

FY25/26 outlook and guidance(6)

Our performance to date, progress in strategic initiatives and our cost and margin discipline, despite softening market conditions in the UK and Poland in Q3, gives us the confidence to upgrade our full year adjusted profit before tax guidance to c.£540m to £570m (previously upper end of c.£480m to £540m). We maintain our free cash flow target guidance c.£480m to £520m, reflecting the newly planned acquisition of a B&Q freehold property in Q4.

Thierry Garnier, Chief Executive Officer, said:

"We delivered another quarter of high quality, volume-led growth, driven by our Group strategic initiatives in e-commerce and trade and by our performance in core and 'big-ticket' categories. B&Q, Screwfix and Iberia continue to strongly outperform their markets. Our performance to date and progress in our strategic initiatives give us the confidence to upgrade our full year profit guidance.

"As we look ahead, we are committed to driving shareholder returns through the consistent execution of our strategic priorities and by being disciplined on margin and costs."

*Underlying sales growth refers to sales excluding calendar and leap year impact. In Q3 the calendar impact is zero, and therefore there is no difference between LFL and underlying sales. (LFL sales +0.9% +0.0% = underlying LFL of +0.9%(2)).

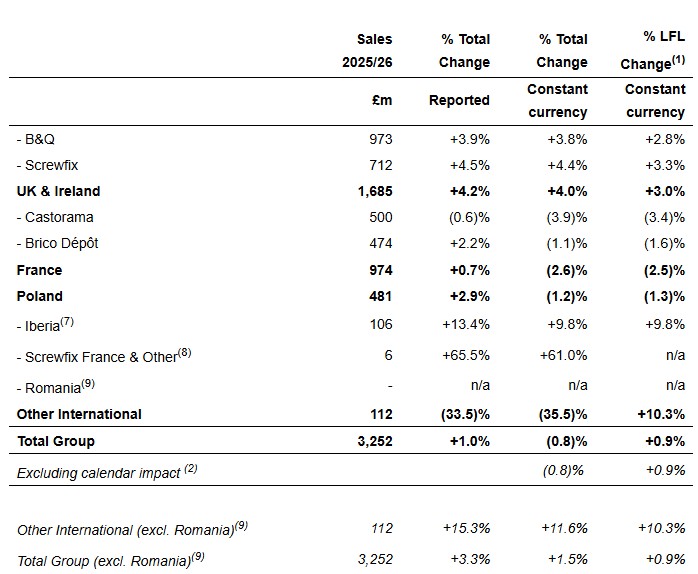

Q3 trading highlights by banner

All commentary below is in constant currency.

UK & Ireland

- Market growth slightly positive on a YTD basis, with Q3 slightly negative(10). We continue to be mindful of inflation, uncertainty ahead of the Autumn Budget and the softening labour market.

- B&Q - Volume and transaction led LFL growth across all categories. Market share gains(3) driven by progress in our strategic initiatives and benefit from Homebase store closures. E-commerce sales rose +19.4% in the quarter with penetration(4) of 16.5%. B&Q's marketplace GMV grew by +43.4% as we continue to improve both choice and convenience for customers with cross-border vendor onboarding and further roll out of marketplace Click & Collect.

- Tradepoint - B&Q's trade-focused banner, delivered LFL sales growth of +3.7%, as the business continued to strengthen its relationship with trade customers.

- Screwfix - Volume and transaction led LFL sales growth, supported by a strong start to the peak trading period (Sep to Nov). Continued market share gains(3) driven by the successful launch of the new loyalty programme and the opening of six new stores.

France

- Market decline of low to mid single digit on a YTD and Q3 basis(10), impacted by weak consumer sentiment, an uncertain political environment, and national strike action in the quarter.

- Castorama - Subdued market as expected across core and 'big-ticket' categories. Seasonal sales were affected by warmer weather. E-commerce(4) and trade sales penetration in the quarter reached 8.3% and 4.5% respectively (up 1.1%pts and 4.1%pts YoY). The restructuring and modernisation plan is fully on track.

- Brico Dépôt - Improving sequential LFL trends by quarter (Q3 of -1.6% vs Q1: -3.3% & Q2: -2.4%). Core categories were the main driver, with continued LFL growth in kitchens following recent range reviews, more than offset by soft bathroom and storage sales. Seasonal sales supported by a successful promotional campaign and a lower weighting of heating categories. Trade sales penetration reached 13.1% in the quarter (up 3%pts YoY).

Poland

- Market decline of low single digit on a YTD and Q3 basis(10). While signs of broader market recovery continue, including consumer confidence and further interest rate cuts, we are yet to see an inflection in the home improvement market with Q3 weaker than expected.

- Performance broadly in line with Q2. Core sales improved versus H1. Big-ticket' sales were slightly down, driven mainly by the bathroom category. Seasonal sales were impacted by weather-related weakness in outdoor products. E-commerce(4) and trade sales penetration in the quarter reached 4.5% and 28.8% respectively (up 1.2%pts and 8.3%pts YoY).

Other International

- Iberia delivered another quarter of strong growth with significant market share gains in Spain(3). Looking ahead, we expect sales in Q4 to be broadly flat, reflecting the strong Q4 comparatives.

- Screwfix France saw continued progress with store LFL sales growth of +51% in line with expectations as sites mature.

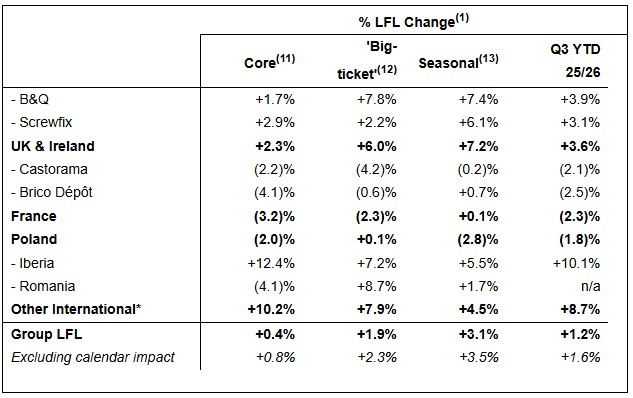

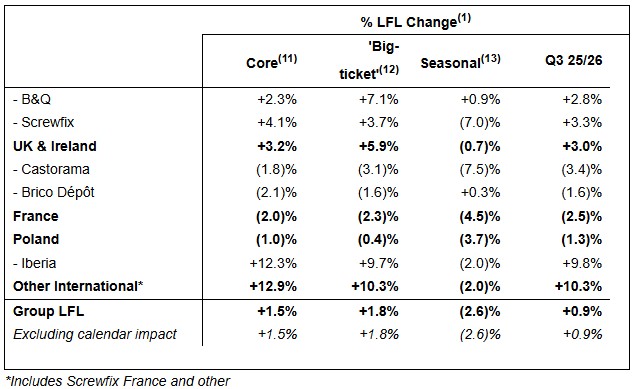

LFL sales by category

Q3 YTD

Q3

Q3 trading highlights by category:

- Core (70% of sales): Regional performance broadly reflected prevailing consumer trends - resilient performance in the UK with an 11th consecutive quarter of underlying LFL growth, and softer trading in France and Poland.

- 'Big-ticket' (16% of sales): Continued growth in kitchen category sales at B&Q and Brico Dépôt France supported by recent range reviews and soft prior-year comparatives. This is partially offset by softer trading in bathroom & storage categories in France and Poland. The Group's order book(14) at the end of Q3 was flat as we annualise last year's range reviews.

- Seasonal (14% of sales): Impacted by warmer weather delaying the start of the heating season.

Update and progress against market outlook for FY 25/26

To support our planning for FY 25/26, we assess various scenarios for the growth of the total addressable home improvement markets in the UK & Ireland, France and Poland in 2025, compared to 2024. The "high case" and "low case" scenarios outlined at the start of the year were as noted below, in constant currency and including expected market space growth:

Market outlook scenarios:

| Our expectation of total addressable | |

| Low case | High case |

UK & Ireland | Flat | Low single digit % growth |

France | Low to mid single digit % decline | Flat |

Poland | Low single digit % decline | Low single digit % growth |

The spread between the high and low cases in each of the markets above is c.3 to 4%pts

Market conditions(10) in the UK and Poland have softened during Q3 supporting our view that UK & Ireland, France and Poland are now tracking between the lower end and middle of the range of our scenarios for the full year.

Guidance

We have upgraded our FY 25/26 PBT guidance to c.£540m to £570m (previously c.£480m to £540m). We maintain our free cash flow target guidance c.£480m to £520m, reflecting the newly planned acquisition of a B&Q freehold property in Q4.

Technical guidance

FY 25/26 income statement (lower net finance costs)

- Space:

- Sales impact of c.+1% from net space growth excluding Romania, mainly from Screwfix UK & Ireland and Castorama Poland (FY 24/25: +0.9%)

- Sales impact of c.-2% from the sale of Romania which was completed ahead of our expectations. - B&Q business rates: Reminder of one-off benefit in FY 24/25 of £33m related to business rates refunds at B&Q (H1 £24m)

- Sale of Romania: YoY benefit of c.£10m to Group retail profit

- Higher wages, taxes and inflation: c.£145m, which we expect to fully offset through gross margin and operating cost mitigations

- Net finance costs: Expect c.£95m (FY 24/25: £100m)

- Group adjusted effective tax rate: c.26% (FY 24/25: 28%)

FY 25/26 cash flow (increased Capex)

- Capital expenditure: c.£370m (previously c.£350m)

- Share buybacks: The £300m share buyback programme announced in March 2025 to be complete by end of March 2026, plus c.£26m repurchased in FY 25/26 related to the previous £300m programme

Source : Kingfisher plc

Image : Kingfisher plc

Insight provides a host of information I need on many of our company’s largest customers. I use this information regularly with my team, both at a local level as well as with our other international operations. It’s extremely useful when sharing market intelligence information with our corporate office.